How Gargantuan Can Private Equity Get?

The previous fundraising boom led to some of the most troubled deals ever done by private equity

By Paul J. Davies

FUNDRAISING FRENZY

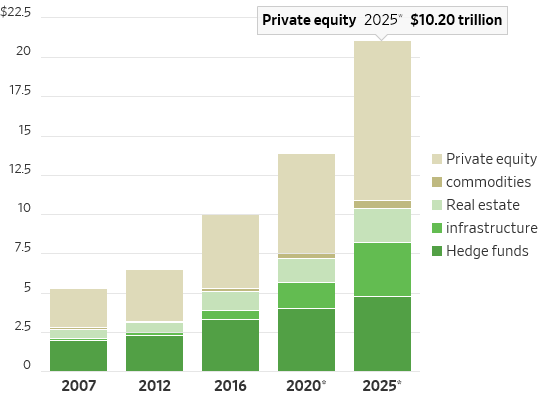

Total assets under management

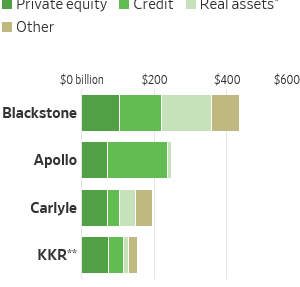

Stephen Schwarzman has a simple mission for Blackstone , the world’s biggest listed private-equity group: double assets under management. For a group that already has $434 billion up from less than $100 billion a decade ago, that sounds ambitious, but Blackstone isn’t alone.

The biggest private-equity firms are in a fund-raising frenzy, fed by insurers’ and pension funds’ hunt for yield and a conviction that private markets will produce better returns than highly liquid and efficient public markets.

Across the entire private equity, hedge fund and alternatives industry globally assets under management are forecast to more than double to $21 trillion by 2025, according to consultants PwC. That would include $10.2 trillion in private equity—or enough money to buy half of the $22 trillion of stocks listed on the New York Stock Exchange today or every stock in mainland China.

Apollo Global Management , APO 1.03%▲ Blackstone, Carlyle and KKR increased their assets by a mind-boggling $247 billion between them just last year — and they all have plans to raise billions more.

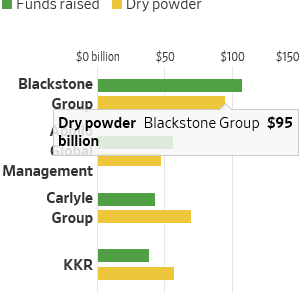

FAT WALLETS

Fundraising in 2017 and univested assets at year end

The question is whether the biggest firms, which have attracted a growing share of the money, can keep finding the returns that have made them such money magnets. The industry built its reputation on being the most active of managers, that trick will be tough to repeat on an ever-larger scale.

Part of their answer is to move away from classic private equity into other areas. First that was private credit, where they double-up on their existing skills by buying and lending to the same or similar companies. That is a smart synergy in good times, but means they can be twice exposed when companies hit trouble.

More recently they increasingly moved beyond their core skills into infrastructure, real estate and other assets sometimes targeting lower returns and tying up money for longer.

Blackstone alone took in $108 billion of new assets last year, but just 12% of that was in private-equity funds, while more than half, or $59 billion, was raised in its credit business, and of that nearly $23 billion was in insurance company assets. Blackstone is following the example of Apollo, which already manages $85 billion for insurance companies it built.

CROSSING ASSETS

Assets under management by type in 2017

The point of all this: generating streams of management fees, which are predictable, steady and valued by public shareholders. On many of their funds, firms collect management fees of 1% to 2% of assets before doing anything. They can then get 20% of the profits as performance fees.

They are tying up investor funds for longer by running listed vehicles that never have to return capital, such as in business development companies, and striking strategic partnerships where investors’ money is tied up for 15 years, instead of the customary eight to 10 years. Scott Nuttall, co-president of KKR, told a conference in December that the firm had good sight of its revenues out to 2035. “And yes, I meant to say 2035,” he added.

When the industry has $1.6 trillion of uninvested money to deploy, $1 trillion of which is in private equity, it is going to be ever harder to find good deals. Valuations on buyout deals, for instance, have risen steadily since the crisis and are now higher at 10.5 times underlying earnings than they were in 2007.

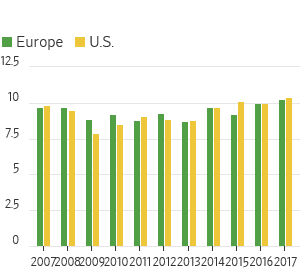

BID UP

Buyout deal prices

as a multiple of earnings

before interest, tax,

amortization and depreciation

The previous fundraising boom led to some of the most troubled deals ever done by private equity: think of Chrysler, or TXU, or Caesars Entertainment . Since the crisis, returns for the industry have been in the low-to-mid teens rather than the 20%-plus levels it built its reputation on.

The more money that floods in, the greater the likelihood of disappointment.

0 comments:

Publicar un comentario