Get Ready for the Fed’s Big Mistake

By Patrick Watson

America is fully employed, or so say the statistics. Federal

Reserve officials think the job market is strong enough to justify higher

interest rates. They’re afraid inflation will get out of control.

But if inflation is a problem, it’s not yet apparent in the

average worker’s paycheck. “Just wait,” the inflation hawks say.

Like many economic dilemmas, this one includes several big

assumptions. One is that having a job

means you have a steady income.

Maybe you want more, but you at least have some kind of reliable baseline.

A pile of evidence says that may no longer be a good assumption.

If so, Janet Yellen and whoever follows her will be making a huge mistake. We

all need to get ready for it.

Photo: AP

Persistent Puzzle

We all know people who are unemployed or underemployed – probably

more than the stats say we should. Are the official numbers wrong?

Yes, they could be flawed. But even if they’re right, it doesn’t

mean everyone is happy about it.

Maybe you lost your job because your company went bankrupt. No

other employers in your area need your skills. You can’t sell the house and

move because you’re underwater on the mortgage. With no better choices, you

take a lower-skilled job at half your former pay.

Someone like that shows up as “employed full-time” in the stats.

Yet they now live in a whole new world.

Such scenarios explain a lot of our discomfort. We have employment

stats, we have income stats, but we lack visibility on how they interact. This

makes a difference.

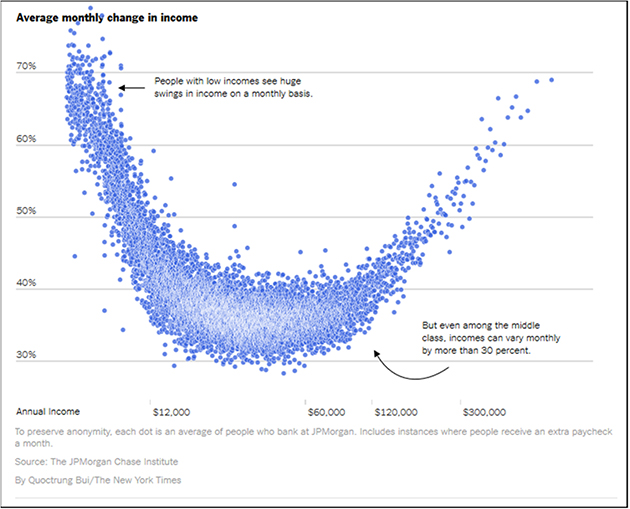

The New York Times

had an interesting story on this point last month.

Mirella Casares has what used to be considered the keystone of

economic security: a job. But even a reliable paycheck no longer delivers a reliable

income.

Like Ms. Casares, who works at a Victoria’s Secret store in Ocala,

Fla., more and more employees across a growing range of industries find the

number of hours they work is swinging giddily from week to week — bringing

chaos not only to family scheduling, but also to family finances.

And a new wave of research shows that the main culprit is not the

so-called gig economy, but shifting pay within the same job.

This volatility helps unravel a persistent puzzle: why a

below-average jobless rate — 4.4 percent in April — is still producing an

above-average level of economic anxiety. Turbulence has replaced the

traditional American narrative of steady financial progress over a lifetime.

“Since the 1970s, steady work that pays a predictable and living

wage has become increasingly difficult to find,” said Jonathan Morduch, a

director of the U.S.

Financial Diaries

project, an in-depth

study of 235 low-

and moderate-income households. “This shift has left many more families vulnerable

to income volatility.”

Sound familiar? It should, if you work in the retailing,

restaurant, or travel industry. They run 24/7 and constantly juggle staff

schedules to meet shifting demand.

Among other things, this makes it very hard to cobble together a

full-time income with two or more part-time jobs. The schedules inevitably

conflict. You can’t be two places at once.

Swinging Paychecks

Data from the JPMorgan Chase Institute shows income swings are

largest among the poor and the rich.

People on both ends of the income scale have similar variability

but they don’t feel similar pain.

Wealthy people have savings and/or the ability to borrow if cash

is low. For those on the lower end, an unexpected car repair or medical expense

at the wrong time can be catastrophic.

Does any of this show up in the unemployment rate? No. People can

be steadily “employed” but in terrible financial condition. And many are.

Maximum Monetary

Uncertainty

To the Fed’s Federal Open Market Committee, which meets this week,

this sort of thing is not part of the mandate. The law charges them with

maintaining full employment and price stability.

The problem here is that “full employment” doesn’t mean everyone

is OK. It can and does coexist with widespread financial misery.

Nevertheless, Janet Yellen and the other members see the sub-5% unemployment

rate as Mission Accomplished. It is their cue to stop promoting job creation and start fighting inflation.

This is why the Fed is (slowly) lifting interest rates and

planning to reduce its bloated bond portfolio. We might get more details

tomorrow.

Predicting what the Fed will do is even harder than usual right

now. The seven-member Board of Governors has three vacancies. President Trump

hasn’t nominated anyone to fill them.

Moreover, Janet Yellen and Vice Chair Stanley Fischer will both

likely retire in early 2018.

We could see five of seven seats change in the next year or less,

and we don’t yet know who will get them. We also don’t know how quickly the

Senate will confirm any new Fed governors.

Next year’s “dot plot” forecasts mean little when the key

dot-makers are halfway out the door and their replacements may have entirely

different ideas.

We are in a time of maximum monetary uncertainty. By this time

next year, the Fed could be…

- Still

on its present slow-tightening course

- Sitting

on its hands and doing nothing

- Raising

interest rates more aggressively

- Cutting

rates lower or even going negative

All those scenarios are completely plausible. Worse, they’re equally plausible. That makes

it very hard to have a matching investment strategy.

So what do you do?

This is a weird environment, and it’s tempting to just sit on your

hands and wait. But if you do that, you may have to wait a long time. You might

miss good opportunities, too.

The best answer is to be ready for anything.

See you at the top,

0 comments:

Publicar un comentario