What Is Really Scary Is Not China's Economy, But Its Currency

by: Global Opportunities Analyst

Summary

- Asian financial crisis of the late 1990s was mainly because of their policy of pegging their currency to the dollar. And the debt was relatively small for Western standards.

- China's current debt load is more than $30 trillion and it's all pegged to the US dollar.

- China's peg to the US dollar does not seem to be sustainable. When the reckoning of this currency peg comes it will be very bad for the whole world.

- Two ways to take advantage of a depreciating yuan would be to short the HK dollar and to short the US stock market.

Should people be worried about Chinese economic slowdown, or an economic crisis in China?

This is a very important question and Western media have been flooded by news of an imminent Chinese economic catastrophe since 2011 at least. There is also a famous book called "The coming collapse of China" written in 2001, predicting the collapse by 2011. The same author came back later and predicted, in 2011, that the collapse would take place in 2012. The book argued, back in 2001, that the hidden non-performing loans of China's massive state-run banks would first bring down the banks, then the Chinese economy, and finally the Communist party. This is actually a prediction someone made back in 2001. You can find a lot more editorial titles about Chinese non-performing loans under the carpet of state-run banks after 2011. Of course things have radically changed since 2001 in China, and of course we all know that neither China's big banks, nor any other important Chinese entity has collapsed. A survey published by Bloomberg, in December 2011, found that 61% of respondents thought that China's bad loans would bring a banking crisis in China within 5 years. We still have 10 more months to go for this particular prediction. Another title, from the BBC in July 2012, reads "Is China's economy heading for a crash?" But stories about an imminent Chinese banking/financial crash started to appear more and more often since 2011, and they haven't stopped multiplying.

Most these titles or predictions ignore China's economic peculiarity because of its combination of an authoritarian regime, and a growth-oriented market economy (I have written about this in a previous article). Although the economy is not a completely open and transparent one (compared to Western standards) in China, it is a growth oriented one. China's leadership, since Deng Xiaoping, decided to pursue policies that would bring economic growth, and they have copied the West (especially the US) in almost everything related to economic policy. And of course, as we all know, they have done an extraordinary job, with an amazing speed. Or at least they have done great economically. In the end, people may be happier with more freedoms rather than with more prosperity (China, as opposed to India)! But that's another issue. The Chinese leadership decided that they wanted to make their country more powerful, perhaps for their own pride, or perhaps for patriotic reasons. Difficult to say!

Have the Chinese rulers made an error that will eventually bring about a financial/economic crisis to China? Since they are no more humans than any others, and since US presidents (who are not supposed to be dumber than those of China, right?), or Fed chairs, or big CEO's and billionaires make mistakes, why can't China's rulers make fatal errors in their economic policies?

I believe they have, and we are all going to pay the price for it. But their problem is not their property market, or their huge (and to some extent hidden) non-performing loans in their large state-owned banks. Western media are missing the point. The real problem is somewhere else, and it's rather a problem for the rest of the world than for China. Their error (with hindsight) has been pegging their currency to the US dollar. Of course, this is nothing new, and even the peg is not an official one. They have taken so many cautionary steps that they (or better to say, we) almost got away with it.

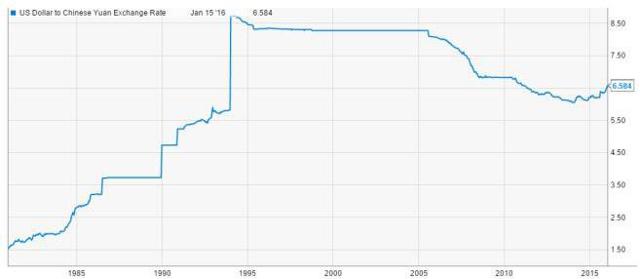

The yuan does not have a complete peg to the US dollar. It used to have one, set at a very low level back then, at about 8.3 yuan per US dollar, between 1995 and 2005 (chart below from ycharts.com). But not ever since, as the yuan was allowed to appreciate against the dollar. And China still has a massive $3.3 trillion (though it has fallen from $4 trillion not long ago) currency reserve it can still use to protect its peg to the dollar. Beside these cautionary measures, China also has a somewhat relaxed capital controls system in place, not allowing their citizens to convert more than $50,000 per year (though dodging it has been easy for wealthy Chinese).

However there is still some sort of a peg to the US dollar, or in fact it is kind of peg in transition from the US dollar to a basket of currencies as they call it. And as we have already seen twice already in a matter of months, every time they tried to loosen their peg against the dollar financial markets sank, once last summer, and another time this January. Why do they want to get away from their peg to the dollar, and why financial markets are so afraid of it, are indeed some very important topics and investors should pay a lot of attention to them. These two topics are likely to be the most important stories of this year, affecting all asset classes around the world.

The reason the Asian financial crisis happened in the late 1990s (1997-1998) was because south-east Asian countries had pegged their currencies to the US dollar - a policy which created a sense of security in taking loans (huge amounts compared to their GDPs) denominated in US dollars. The loans grew, and when the reckoning came the crash occurred very suddenly. A longer version of the story is available at this IMF (International Monetary Fund) page.

That crash did not affect Developed Economies much, but it ravaged Emerging markets. It spread all over the world and caused panic among investors. Panicked investors liquidated their Emerging Market exposures, adding to an already serious financial squeeze.

Back then in the late 90s Emerging markets were almost nothing compared to the Developed World. Their economies were minuscule. The whole crisis started in south-east Asia, where the economies are not so big even now, after almost two decades. Although the contagion made the crisis much bigger, that is another issue. The root cause was not of particular concern to Developed markets because of the relatively small size of the fundamental problem. In 1997 affected Emerging economies entered the crisis with dollar denominated debts which never approached 200% of their GDP. And all the US dollar debt, in Thailand, Indonesia, Malaysia and South Korea were in the tens of billions for each country. The IMF ended up saving the situation with total loans of about $100 billion (longer story).

Fast forward to today, and we have a new situation, but on heavy steroids! Our current situation has a lot of similarities, and some misleading, but rather serious, differences. China's total debt is believed to be around 300% of GDP, though precise numbers are impossible to find (even for the US they are not clear). But no matter how you look at it, even according to Chinese official data, China's debt is staggering. But so is total debt in the US, and far worse in many other countries like Japan, UK, Italy and so on. The only difference is that China has a pegged currency. And this is the dangerous part. It's more dangerous to the rest of the world than to China itself. Of course, in the case of a collapse of this peg, the rest of the world will suffer a huge financial crisis, and as a consequence Chinese economy itself will suffer no less.

The numbers are quite 'interesting' (in a scary way)! China's GDP being around $11 trillion as of the end of 2015 (I suppose the figures are relatively accurate), total debt to GDP is supposed be over $30 trillion. That is not denominated in US dollars, so China doesn't owe most of that money to anybody other than within the country, however almost $30 trillion of Chinese debt is pegged to the US dollar. I repeat, OVER $30 TRILLION of debt outside the US is pegged to the US dollar! Back in late 90s, the Asian financial crisis happened as foreign investors panicked because of tens of billions of dollars of debt. Now the debt is more than $30 trillion. If China did not have a US dollar peg they could have just printed their way out of debt. America has done it so many times. Europe and Japan are actively doing it now. But China can't, because it has to keep the yuan steady to the US dollar.

Such a critical situation cannot go on for long. Somebody has to blink. Either the Fed has to print a lot of money to accommodate China's debt, or China has to print a lot of yuans and let the peg loose. The Fed is actually contemplating raising rates, not the massive easing China desperately needs. And China seems to be intent on letting the peg ease, and it doesn't really have much choice. Another solution would be for China to artificially maintain a peg to the dollar by imposing heavy capital controls. One of these two measures, or more probably a combination of both, will have to be taken. Both of the measures, keeping in mind the size of the Chinese economy and its importance to the world economy and trade, will be huge negatives for markets all around the world. A steep yuan depreciation will mean a huge dose of deflation exported to the rest of the world, while strict capital controls will deprive the rest of the world from exporting much to China, or receiving investments from China. Imagine Greece, but 46 times bigger! Greece has a currency (or a complete peg to the euro) it cannot afford, so it has ended up only with very strict capital controls in place, and also an economic situation nothing short of a depression. What differentiates China from Greece though is the ease with which China can, upon choosing, depreciate its own currency, hence avoiding any threat of an internal economic depression.

Only capital controls will not be very effective with China's debt problems inside the country.

That would be disastrous for employment. China needs a lot more inflation to be able to improve the plight of its over-indebted industry. China needs the freedom to print a lot of yuans.

In any case, things are likely to get a lot worse before they get any better. The reckoning of China's currency imbalance may prove to be the starting point of a global panic, and the rest of the world will not be spared the pain.

There are several ways, to my opinion, one can also take advantage of this imbalance. In the case of a further yuan depreciation it is terribly unlikely for the Hong Kong dollar to be able to hold its peg to the US dollar. That is a very old peg and its collapse could take the Hong Kong dollar down against the US dollar to crisis levels. Hong Kong economy is pretty much a small component of the Chinese mainland, where almost every aspect of the economy is dependent on mainland China. Another way to take advantage of a yuan depreciation would be to simply short US indices (SPY, QQQ). US stocks are near their record highs, and no major stock market will be able to handle a deflationary tsunami coming from China.

0 comments:

Publicar un comentario