Emerging Markets Outlook 2016: These 3 Factors Make Or Break The Region Next Year

- Emerging Markets were a huge disappointment for investors in recent years and 2015 in particular.

- The leading EM ETF shows a remarkable exposure to Asia and China.

- There are three factors which can revert the negative trend: China, politics & reforms, and reversal of flows.

- Valuations are very attractive, but they will not be enough to change the trend.

- For long-term investment mandates, current levels may offer a decent entry.

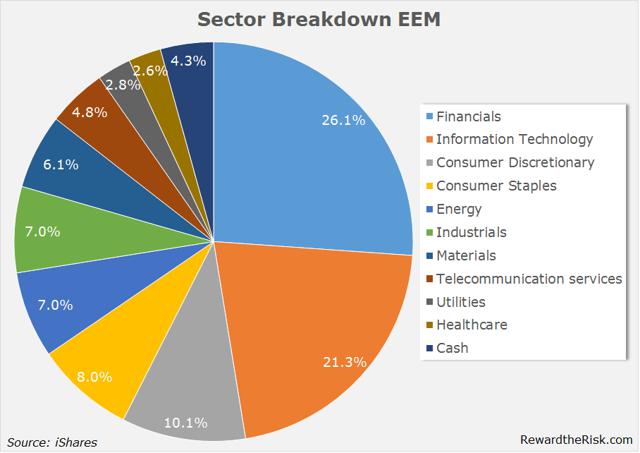

Actually investors are back on levels last seen in 2009, which raises the question if the E in EM is still valid. From a fundamental point of view, we witnessed that a number of countries from the EM-spectrum had a rough year. For example, the two BRICs, Brazil and Russia, are experiencing a recession due to a collapse in commodity prices and (geo)political issues. As a whole, the EM-group saw growth slowing down to 3.8%. But 2015 is now largely behind us.

Let's look at what the prospects are for emerging markets and EEM, since this ETF is the most straightforward way for individual investors to play this type of markets.

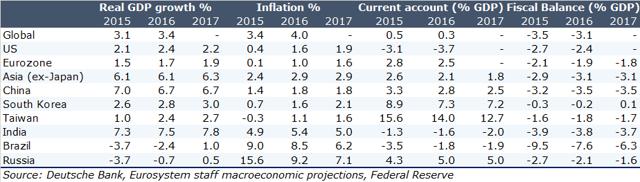

(click to enlarge)

Huge Asia-exposure

It is important to realize what exactly you are buying when investing in emerging markets.

Since definitions vary, it is not always clear which country is and which isn't an emerging country. For instance, MSCI regards Argentina as a frontier market, whereas media frequently note the country as an emerging market. EEM, which tracks the MSCI Emerging Market Index, therefore doesn't include Argentina. Furthermore, with all the attention on BRICs, one might expect these four countries to have a large share in the breakdown of the ETF assets.

However, Brazil and Russia don't make it to the top five. The poor performance of Brazil's stock exchange caused exposure to drop to 5.4%.

Russia is, with a weighting of 3.4%, relatively small.

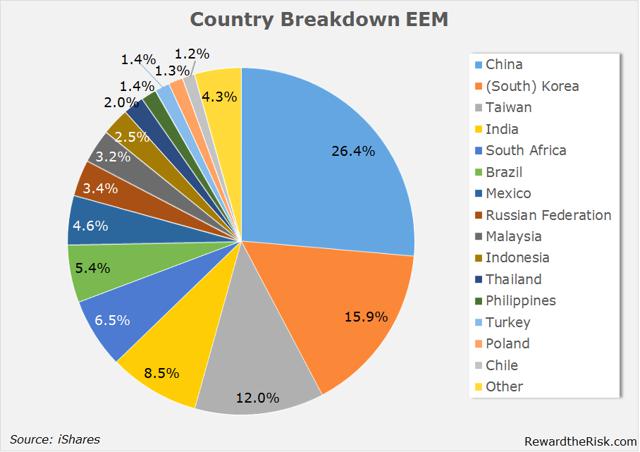

(click to enlarge)

The chart with the breakdown also highlights the huge exposure towards Asia. In fact, more than 72% of the assets are invested in Asian markets. Latin America and Emerging Europe and Africa (EMEA) have a roughly equal share of approximately 12%.

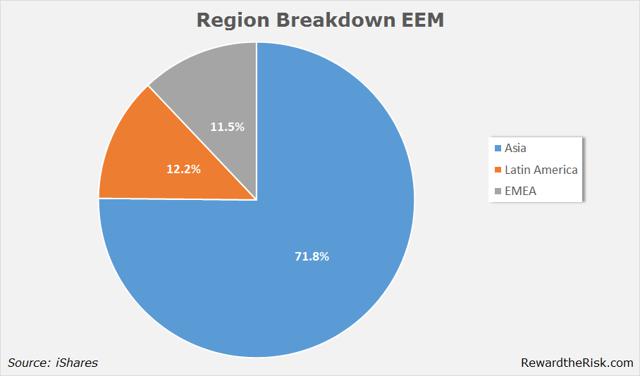

(click to enlarge)

A number of analysts point to the importance of commodity prices when investing in emerging markets. This does apply only to a small extent for EEM. A relatively small exposure towards Brazil and Russia explains this in part. Energy (7.0%) and Materials (6.1%) are small sectors.

The top-3 sectors are Financials (26.1%), Information Technology (21.3%) and Consumer (18.1%).

(click to enlarge)

The large weightings of South Korea and Taiwan are directly linked to the significant exposure towards information technology. EEM's largest holding is Korean Samsung Electronics with a weighting of 3.5%. Actually the top-3 holdings are all active in the information technology sector (no.2 is TSMC, no.3 is Tencent). Nonetheless, there's a striking difference between companies from Taiwan and their Chinese and Korean counterparts. While Taiwan is one of the world's largest Original Equipment Manufacturers (OEM) and holds a competitive advantage in cost-efficiency, it is struggling with brand awareness. In fact, whereas in recent years South Korea and China conquered the world with their brands Samsung, LG, Huawei and now Xiaomi, probably few people could name Taiwanese brands. Although HTC is well-known, it is struggling with its sales. The focus of Taiwan on process improvement and cost-consciousness led to a neglect of marketing and sales, or a failure in brand building. This could be an important burden in the future.

First factor for a turnaround: China developments

Obviously with slightly over a quarter of assets allocated towards China, developments in the Chinese economy are an important factor for EEM. But the China exposure doesn't stop at Chinese holdings. A large part of the Asian region is strongly related to the Chinese economy.

For instance, China accounted for 38.7% of Taiwan's exports and 21.6% of GDP in 2014 (source: Lazard Asset Management). Almost 60% of these exports are electronics [IT]. China is South Korea's largest trading partner with bilateral trade amounting $235 billion in 2014 (source: Ecns.cn). But also for commodity markets Brazil and Russia, and South Africa as well, demand from China plays a big role.

A large part of the huge drop in commodity prices is attributed to a slowing Chinese economy.

A further drop on the demand-side would not help the above mentioned economies, however one might wonder how much room there's left on the downside for commodity prices.

The Chinese economy is in a transition to become a more diversified economy. Policy makers are steering the country towards a more consumption driven economy. The good news is that China's consumer sector is growing with double-digits on an annual basis. In November, retail sales increased 11.2% YoY. In the first 11 months of 2015, total retail sales amounted to 27.2 trillion yuan, which corresponds with approximately $4 trillion.

The strong development of the retail sector matters a lot for EEM. Keep in mind that 18% of AUM is focused towards consumers. In addition, a number of the underlying companies are directly benefiting from higher sales through the internet. During the period January to November, online sales increased by 34.5%. The strong rise of internet shopping in China is good news for EEM-constituents Alibaba (NYSE:BABA), JD.com (NASDAQ:JD) and Vipshop Holdings (NYSE:VIPS). All three companies were added to the MSCI EM Index starting from December 1.

We should make an important note on China investments in EEM. This year's turmoil on the Chinese stock market was well covered in the press. But this was related to the mainland-traded A-share market, which is a separate exchange from the typical H-share market. H-shares are listed on the Hong Kong Stock Exchange and these are the shares that are constituents of MSCI indices.

Furthermore, as mentioned above, ADRs listed on US markets can also be included in the MSCI EM Index.

Second factor: political will to reform

As China's example of shifting economic policy targets illustrates, a number of emerging markets need to reform their economic policies. Although the big picture of China's reforms indicates that policymakers are aware that the old investment- and production-driven growth is no longer feasible, recent reforms are a bit disappointing. Real market-oriented reforms that spur competition are still largely absent. To be fair, China's move towards a floating exchange rate is a major step in the right direction.

What's more troublesome, other emerging markets are caught in a struggle for political power and the need to implement unpopular reforms. Brazil's administration is desperately putting all its energies into retaining power as a result of widespread corruption scandals. The current crisis means that there's little attention for implementing reforms that steer the country clear from its major dependence on commodities. Also Russia needs to boldly reform to turn the country into a more diversified economy. The previous crisis in 2008-2009 was apparently too short, i.e. commodity prices recovered too quickly to urge policy makers to take necessary steps. Now with a new collapse in oil and ore prices, the country is in a recession anew.

Domestic politics are of less concern, but geopolitics are.

Foreign investments and access to capital suffered due to the Ukraine crisis. A time path for lifting international sanctions against Russia is still not on the horizon, with the US imposing fresh sanctions recently. The good news is that for 2016 the refinance need for Russian companies is relatively low.

The ruling administrations in South-Africa and Turkey are putting too much energy into party politics, either to retain power or to enhance the position of politicians. This is bad news for reforms.

Some other countries, such as India and Indonesia, but Mexico as well, saw new leaders gain power recently. Although these leaders were elected promising reforms, their ambitions have not turned to reality due to difficulties in implementation. Argentina shows how it should be done by the bold reforms already implemented shortly after a new administration took office. If only Argentina were included in EEM…

But there's another political story that affects EEM: elections in Taiwan. In January, Taiwanese voters will elect a new president as well as a new legislature. These elections are for a large part centered around the country's position towards China. Current polls indicate a victory for Tsai Ing-wen, the leader of the opposition DPP (Democratic Progressive Party).

Although Tsai didn't reveal much of her stance towards China, some worry that ties may struggle more than under candidate Eric Chu from the ruling China-friendly Nationalist Party.

On the other hand, this should not be exaggerated because much of the election was run on domestic issues, such as coping with rising cost of living against stagnant wages. Furthermore, the economic ties between both countries make clear that no one will benefit from increasing tensions.

Third factor: it's all about the flows

In economic flourishing times, politics move to the background of investors' attention. But in the current situation of relatively sluggish growth, even compared to developed economies, this topic does matter. Why would you move funds towards a country with similar growth perspective but with weak governance? This question indicates that it all comes down to a risk/reward evaluation. For the recent years, in particular this year, international flows showed that this question received a negative response. According to the IIF (Institute of International Finance), this year net capital inflows turned negative for the first time since 1988 and could amount to as much as $540 billion. IIF estimates that next year net capital flows to emerging economies will remain negative at a minus of $306 billion.

The steep drop in flows is for a large part the result of a lack of direct investments. Gross inflows halved compared to a year earlier.

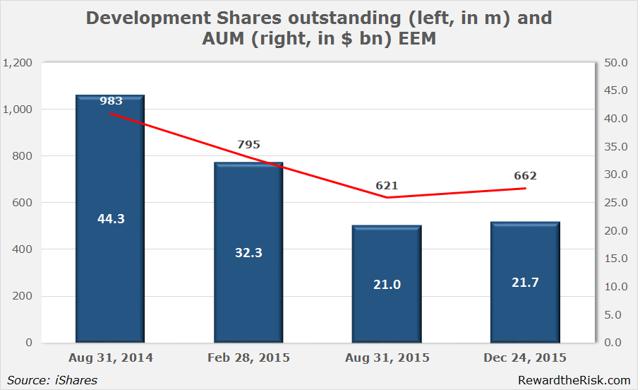

The negative trend in flows is also seen in EEM. Compared to February 28, AUM (assets under management) declined from $32.3 billion to $21.7 billion as at December 24. AUM more than halved during an 18-months period. Although a part can be contributed to a decline in share price, the number of shares outstanding decreased from 795.2 million to 662.4 million. To be fair, since late August, some new shares were sold. But compared to less than 18 months ago, the ETF saw its number of shares outstanding decline with approximately a third (see graph below).

(click to enlarge)

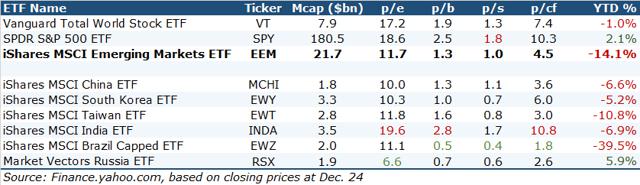

Many market watchers are wondering whether we have seen the top of fund outflows. As indicated in my previous article on Market Vectors Russia ETF (NYSEARCA:RSX), dated October 24, the low valuations attract investors who consider current levels as an attractive entry level. With an average price-to-earnings ratio of 11.7, investors get a discount for EEM compared to the US market. The SPDR S&P500 ETF (NYSEARCA:SPY) is currently trading at a p/e ratio of 18.6 and the Vanguard Total World Stock ETF (NYSEARCA:VT) is trading at a p/e ratio of 17.2. To be fair, a number of individual emerging markets are trading at a much lower p/e ratio. For instance, RSX is trading at a p/e ratio of 6.6.

(click to enlarge)

Attractively priced or not, the fact is that the larger part of fund managers is heavily underweighted in emerging markets. According to a December 15 survey by Bank of America Merrill Lynch, a net 27% of fund managers hold underweight positions in emerging markets.

This is down from the net 34% in September, which was the largest underweight-position since 2006. Net underweight means that the percentage of underweight is x% greater than fund managers reporting an overweight position. The significant underweight-position doesn't necessarily mean that these fund managers will become buyers of emerging markets in a jiffy, but it indicates that the potential of fresh buyers is substantial. In case momentum turns, there's a large amount of potential inflow.

A look at the chart

As mentioned earlier, current price of EEM is at levels last seen in 2009. Chartists will love the 2015-low, since this one is close to a 61.8% Fibonacci retracement of the bull move from late 2008 until 2011. So EEM may be at a critical level from a chartist point of view.

(click to enlarge)

2016: a return to green valleys?

That said, before the investment climate turns really positive, significant adjustments need to be made in a number of emerging markets. Current valuations for emerging markets as a group may offer an attractive opportunity when one holds a long-term investment horizon. The cautious inflows for EEM in the second part of 2015 could indicate that some investors are ready to (re-)add exposure towards emerging markets at current prices. But as highlighted in this article, before adding EEM, one has to be a firm believer in Asia and in China in particular. Investors who think individual markets may have gone too low recently, such as Russia or Brazil, are better served with country-specific ETFs.

Nevertheless, with valuations significantly below that of developed markets, EEM offers an attractive investment thesis for 2016 and the years to come.

0 comments:

Publicar un comentario