A Uniquely American Problem

by: Shareholders Unite

Summary

- Until now, the US economy recovered fairly briskly from the financial crisis, with solid private sector growth.

- The US recovery is much better than in most other areas of the world economy.

- But there is one area where the US lags, and that is wages.

- But US wages have been stagnant for decades, and this turns out to be a surprisingly US problem only.

- The US recovery is much better than in most other areas of the world economy.

- But there is one area where the US lags, and that is wages.

- But US wages have been stagnant for decades, and this turns out to be a surprisingly US problem only.

We argued (here) that the unusual amount of gloom and doom in the US is largely unwarranted as the economy didn't fall into a depression post 2008.

Also, markets have ratcheted up, private sector employment creation has been as good as in any recovery (certainly better than the post 2001 recovery) and there has been a fair amount of deleveraging post 2008.

We also argued that compared internationally, the economic performance of the US has been rather good, despite the headwinds coming from the deleveraging, public sector employment loss, and rising dollar.

However, we're not blind optimists, and acknowledged that actual GDP growth has disappointed historically, and tried to explain that (here).

Not only has growth disappointed, it is also increasingly distributed unevenly as inequality exploded.

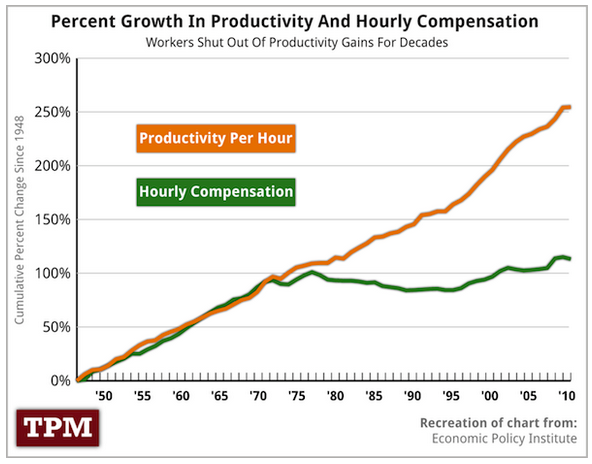

Median wages are little higher than they were in the 1970s, despite all the productivity gains since.

This, for us is the real problem of the US economy, and as we show below, it's fairly unique to it as well.

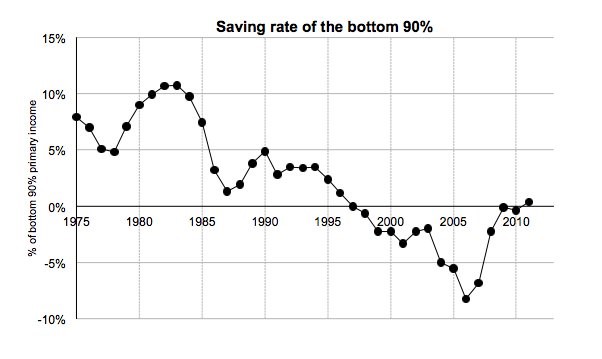

The slowing growth has been increasingly dependent on increasing debt as the stagnating incomes at the middle were supplemented by borrowing in order to share in the increase in living standards.

Below you see how, from the mid 1980s (after the recovery from the recession), the saving rate is going down for 90% of households.

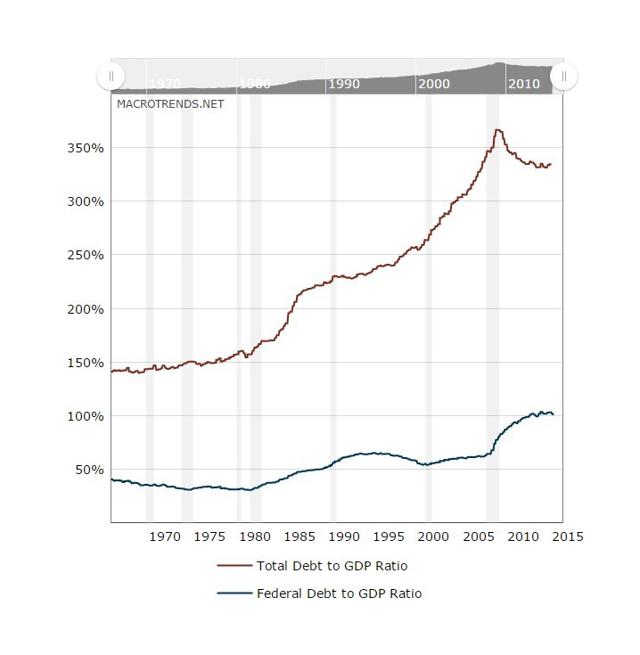

Of course this wasn't (and isn't) sustainable as debt/GDP ratio's ratcheted up ever higher.

To top off the economic problems, the exploding debt, combined with slow growth and absence of any meaningful inflation is a particularly toxic cocktail producing very unfavorable debt-dynamics in the form of the denominator effect, where due to stagnant nominal GDP debt ratio are ratcheting up.

Despite that, the US managed to actually deleverage post 2008 financial crisis, despite the public sector's releveraging.

So we have stagnating median incomes for decades, which led large swaths of the middle class to leverage up in order to share in the increasing wealth creation.

These stagnating incomes are often blamed on a combination of:

- Globalization: the competition from low wages abroad plus the threat of offshoring.

- Technology: automation replacing unskilled and semi-skilled employment.

- Education: the US losing its advantage in mass education.

For instance, here is Robert Reich widely shared view:

Technology and globalization haunted dreams of American middle-class prosperity.

Machines displaced low-skilled (and increasingly middle-skilled) workers whose routine jobs could be automated, and globalization meant the flight of manufacturing and service jobs to factories and call centers in emerging countries.

The result was ever-widening inequality.

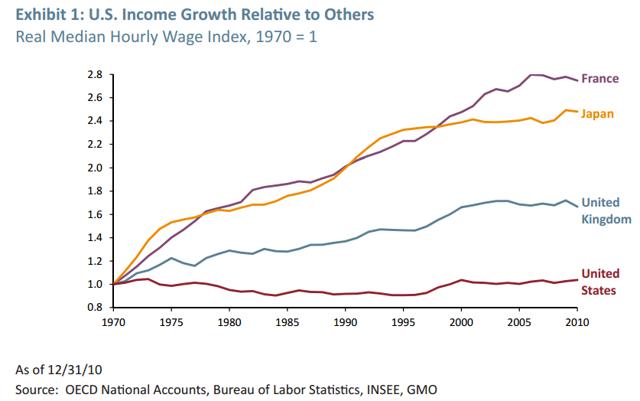

But here is a particularly brutal figure:

This is simply extraordinary. It turns out wages in France and Japan, often considered economic basket cases, have grown 2.5 times as fast as those in the US.

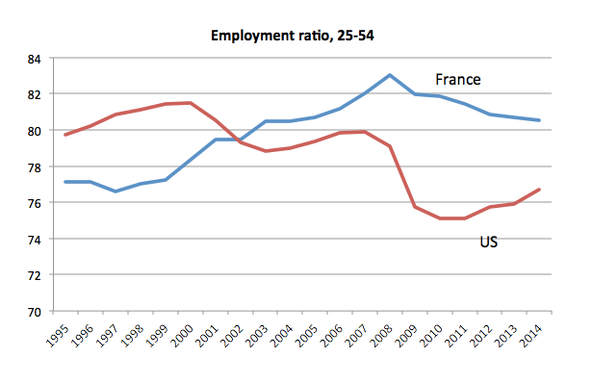

A possible retort to this could be that while wages have been growing much faster in sclerotic France, this could have come at the expense of job creation. After all, higher wages could mean labor pricing itself out of the market and France isn't well known for its economic dynamism anyway.

But then there is this figure showing that while France has managed to increase employment for it's working age population, the US hasn't.

The figure is likely to be somewhat flattering to France as early retirement is likely to be considerably higher compared to the US, but still, it's difficult to argue France has done worse on employment despite much better wage growth.

But there is a much more fundamental and important conclusion to be drawn from these developments. Japan and France are very much under the same forces of globalization and technology which are often deemed the culprits of the stagnant wages in the US.

This points squarely to domestic causes for the stagnant median wages in the US. That is actually good news, as policies and institutions can be changed, while globalization and technology are much bigger and powerful forces.

One can tinker with the consequences of technology and globalization, to alter them isn't really a good idea, witness the plight of countries that shut themselves from world markets.

The conclusion about domestic causes is confirmed by other stuff, like the plight of the white middle-aged, especially those with just a high school diploma or less. Unlike middle aged whites in other rich countries, and most notably unlike other American ethnic groups, their life expectancy isn't increasing.

Here is Fareed Zakaria:

The main causes of death are as striking as the fact itself: suicide, alcoholism, and overdoses of prescription and illegal drugs. "People seem to be killing themselves, slowly or quickly," Deaton told me. These circumstances are usually caused by stress, depression and despair. The only comparable spike in deaths in an industrialized country took place among Russian males after the collapse of the Soviet Union, when rates of alcoholism skyrocketed.

A conventional explanation for this middle-class stress and anxiety is that globalization and technological change have placed increasing pressures on the average worker in industrialized nations. But the trend is absent in any other Western country - it's an exclusively American phenomenon. And the United States is actually relatively insulated from the pressures of globalization, having a vast, self-contained internal market. Trade makes up only 23 percent of the U.S. economy, compared with 71 percent in Germany and 45 percent in France.

It's also an interesting debate exactly which domestic policies and institutions are responsible for the stagnant wages in the US, but we'll leave that for another article.

Investors complain (rightly, in our view) about the quality of earnings and the lack of topline growth for many companies. The source of this is remarkably simple.

It's difficult to have robust topline growth when wages are stagnant, and they have been stagnant for quite some time. Yes, this effect was masked for a while.

First by women entering the workforce en masse (1970 - 1990s) and then by the great leveraging up, that is, the credit boom largely based on the housing boom.

Now that these two countervailing forces have exhausted themselves, the stagnant wages are laying bare and the economic consequences can no longer be masked.

They show up in disappointing topline growth, reducing capex, an aging capital stock and hence slowing productivity growth, financial engineering and even as a disgruntled electorate which feels the game is rigged against them.

0 comments:

Publicar un comentario