Oil Deflationary Scare Threatens Fed's Rate Hike Resolve: Outlook For Gold

- Oil breaking below $35/barrel puts some deflationary pressure, and risks some Fed dovishness in the process.

- Should the Fed fail in first rate hike, it likely means the gold sell-off will be less meaningful than projected, and the effect would also likely contain volatility.

- However, I believe the most likely outcome is that the Fed follows through with the first rate hike as projected.

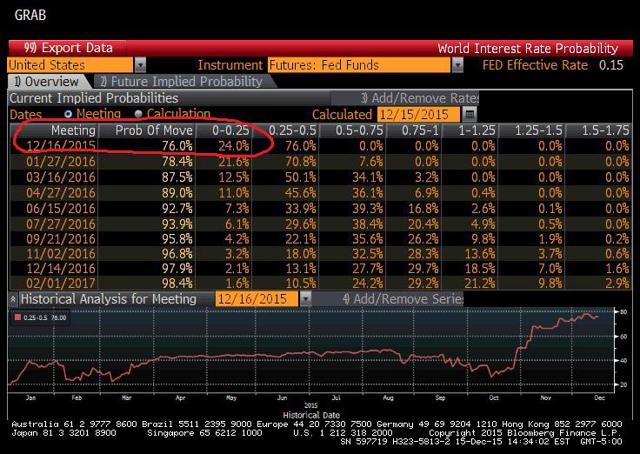

- The market has already priced in a hike, and the past few weeks have been littered with hawkish rhetoric from Fed officials.

- Content to hold GLD shorts and add to VIX short ~25.

The most significant move this week comes in the form of lower oil prices and oil volatility. Until this week, the market was all but certain that the economy could handle higher rates. But now, a shadow has been cast across the all-but-certain result of this week's Fed meeting.

(click to enlarge)

With reference to my last article, numerous Fed officials have shown their hand regarding this week's FOMC meeting. Many indications has been given that this meeting is the likely meeting for the first rate hike. However, with the break in oil, it seems the circumstances have changed slightly.

Instead of the Fed coming out with a hawkish statement AND a rate hike, I believe it's now more likely that the meeting results in a rate hike of 25 bps, with more dovish dot projections and rhetoric.

But I believe the meat and potatoes of the meeting will remain the same, and the rate hike remains in place.

(click to enlarge)

How to play it

Gold (NYSEARCA:GLD)

The core gold short positions remain in place, with gold struggling to make new lows. For short to intermediate moves, we're still eyeballing the meeting tomorrow. The Fed meeting will determine where bonds go from here, and thus gold. At this point, the Fed hike is already priced into the market, so I believe it's unlikely to move the bond prices or gold from here. The tone of the meeting and dot projections will be the key to watch.

If the Fed indicates more rate hikes to come early in 2016, the metal will likely fall lower. However, if the tone is more dovish, which is certainly a possibility given the latest move in oil, then it's less likely that we see strong price action to the downside in gold or bonds.

The intermediate-term direction of gold remains bearish, with rates likely to rise in the future.

However, given that this is already priced in, I'm not looking to add to any positions at the moment, and am happy to hold my current GLD positions.

To clarify, I'm bearish on gold in the intermediate term from a trading perspective. I believe we will see lower prices before this multi-year bear market finally reverses. For all of you perma-gold bulls, allow me to state that I'm a supporter of gold as a steadfast currency and long-term store of value in its physical form. I am, in fact, fundamentally bullish on gold from a very long-term standpoint, but for a trade in the intermediate term, I believe we see lower prices and a continuation of this multi-year bear market. In our current environment, futures contracts and paper gold control the direction and movement of the yellow metal. Until this changes, we must acknowledge this fact. It's important to distinguish the difference between an intermediate trade and a fundamental, long-term viewpoint.

(click to enlarge)

With that being said, from a technical standpoint, $1080 is preventing upward movement. The RSI and MACD crossover presented a possibly moderate bullish move in gold prices, and gold failed to see any sort of upward momentum into this week's FOMC meeting. At this juncture, any sort of catalyst would need to be fundamental, which would also mean we would need to see very dovish moves and rhetoric from the Fed to reverse this continued bear momentum.

My current gold shorts are intermediate in nature and looking to take advantage of the continued secular bear market. Even if the Fed comes out with dovish tones and leads to gold moving higher (likely the $1120 area, if that's the case) then this will be an opportune time to add to our shorts. If the Fed has a hawkish tone to complement a rate hike, then I think gold will make a quick decline and look to take out the next support level around $1030.

VIX (NASDAQ:XIV)

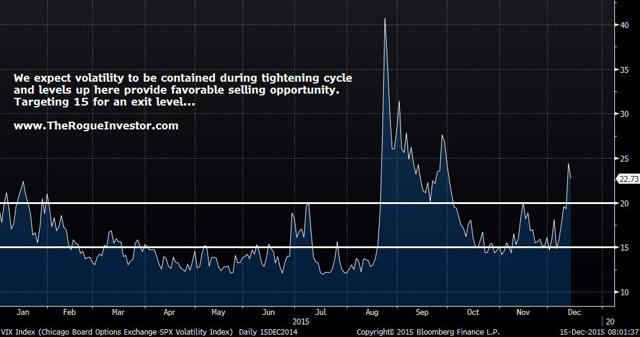

During this week, oil sold off along with equities and created a more volatile environment. With the VIX spiking to ~25, I've used this opportunity to add a short VIX (XIV) position based on the premise that during a tightening cycle we anticipate less volatility and believe this spike will be short lived. I am looking for the VIX to normalize around the 15 level to exit the position in the coming weeks or months.

(click to enlarge)

Future Trade Ideas

Financial stocks (NYSEARCA:XLF) have underperformed this week. In a rate hiking environment, these would likely perform as well or better than the S&P. Should this relative trend continue, I'm looking into a trade that would express financials outperforming the S&P next year. However, I'm not looking to put on this trade right now, and am happy to watch.

(click to enlarge)

0 comments:

Publicar un comentario