Will 2016 Be Like 2000 Or 2008?

Summary

2016 will see a contentious presidential election after a two term president's administration comes to a close.

The last two times this has occurred (2000 & 2008), the stock market has suffered substantial declines.

With global growth anemic and the market trading above historical valuations, are investors ignoring the possibility of a very tough year ahead?

History doesn't repeat itself, but it does rhyme. --Mark Twain

2016 will bring a contentious presidential election with a two term president in official "lame duck" status. From a recent historical perspective, this kind of transition has coincided with some significant bear markets. Obviously 2008 instantly springs to mind as a year when this type of election happened along with a rout in the market. 2000 was another example with a presidential transition year occurred at the same time as a market meltdown as the NASDAQ was cut in half during the "internet bust".

The last time this scenario happened outside 2000 & 2008 was in 1988, which was a solid year for the stock market. However, maybe the overlap was just a few months off that year as "Black Monday" took equities down more than 20% in one day in late October 1987.

Obviously, there were other factors that caused all of these market meltdowns but one has to admit the correlation is not encouraging. The contentiousness of the upcoming election is hardly going to be positive for the market. We have already seen election driven rhetoric around drug price "gouging" help hurl the biotech sector into official bear market territory before the space rebounded higher in yesterday's trading. The first Democratic debate also feature myriad attacks on "Wall Street", and we are not even to the Iowa caucuses yet.

Given the high negatives in polling of the presumed Democratic nominee and the fact that the vast majority of the electorate feels the country is heading in the "wrong direction"; this upcoming election could be particularly nasty particularly when a frontrunner emerges from the current circular firing squad that is going within the Republican nominating process.

Politics is just one factor that could prove to be a negative in the upcoming year. 2016 has elements of both 2000 & 2008. Like 2000, the Federal has pumped liquidity into the market that has caused asset prices to rise. In 1999 the central bank provided its largesse due to concerns around Y2K, which turned out to be a non-event but was one factor in the huge Internet Boom that year. This of course turned into the Internet Bust in March of 2000.

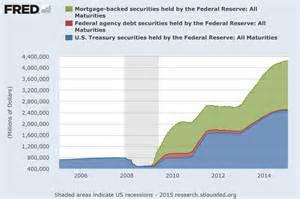

Of course, that was a minor blip compared with what the Federal Reserve has done over the past six years by quintupling its balance sheet to over $4 trillion and change. This obviously has played a part in the huge rises in asset prices in stocks, real estate and even art. How much of a factor is anyone's guess. Luckily, although the market is above historical valuations based on earnings, it is not at the outrageous levels of 1999. A lot of the speculative juices seems to have flowed to the so called "unicorns" in the private market like Uber, Airbnb and Therenos.

(click to enlarge)

Like 2008, we are starting to see some stress in the high yield market. Instead of subprime, it is the commodity and energy complex that is starting to see distress across many of small, mid-tier and large players such as Petrobras (NYSE:PBR) as well as sovereigns such as Brazil which just saw its debt rating cut to one notch above junk. Corporate bonds in that country have gone from five percentage points above treasuries to nine percent since August.

I

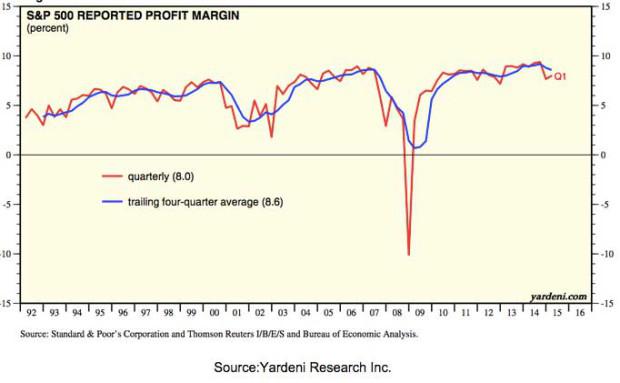

n addition, like in 2008 there is no current year-over-year earnings growth in the market as both the second and third quarters of the year will actually post slight year-over-year declines for the profits of S&P 500. Global growth is also decelerating. With margins at all-time highs (~10.5%), there is little room for earnings improvement through cutting costs. In fact, with local, state and federal governments trying to significantly raise minimum wages throughout a good part of the country; margins are likely to deteriorate. One only needs to look at the huge hit in profits Wal-Mart (NYSE:WMT) took and the associated decline in its stock this week to see what even a small raise in wages across the board can have on low margin businesses like retailers, restaurants and other service industries.

The scary part is if we do hit a rough patch in the economy in 2016, what is going to rescue the market/economy with the Federal Reserve at zero percent interest rates and a balance sheet that has ballooned since 2008? Combined with what continues to be the weakest post war recovery on record, there is not much leeway to handle any kind of global hiccup that presents itself in the upcoming year.

Given all this, I am extremely cautious as we approach 2016. I plan to use any year-end rally especially in biotech which I have been adding "dry powder" to since August and noted yesterday looks like it has bottomed; to raise cash up to 30% of my overall portfolio before the New Year. With so many negatives in the market, the presidential election and its recent correlation to big moves down in the market is just one more reason to be cautious going into 2016.

0 comments:

Publicar un comentario