A Fed Raise Conundrum, Part 2 - Would There Be Pain?

Summary

Discussion of August 27th Q2 GDP estimate and ECB M1 measures.

Analysis of long term Fed employment and inflation targeting; and economic growth since 1998 by Fed inflation measures.

Discussion of current contractionary monetary policy and Keynesian equilibrium rate doctrine.

Discussion of the Fed toolkit; FFR (Fed Funds Rate), IOER (Interest On Excess Reserves and RRP (Reverse Repo).

- 75% chance of a Fed raise before the end of the year.

- 25% chance of a Fed raise on Sept 17th, 2015.

- 25% chance of no Fed raise in 2015.

- All TBD

In fact, markets aren't just saying that tightening policy is a bad idea; they are saying that policy is tight now and getting tighter. That's what falling interest rates and a rising dollar - falling commodity prices - mean. If monetary policy was sufficiently loose, those things would be going in the opposite direction. - Joseph Y. CalhounWith the advance Q2 GDP number +3.7% released on Aug 27th, this was probably the discussion going on in Jackson Hole. Many Fed members skipped the conference, perhaps to avoid discussing this very sensitive matter with other attendees.

The Aug 27th US Q2 GDP est. at +3.7. Upon further review, +3.1 was +85B in gasoline savings spent as PCE by cash starved (wages are not rising) consumers on automotive and durable goods one off repairs and purchases. Clothing and eating out also got a nod. The Fed would raise?

AEP at Telegraph, "Reflation threat to bonds as money supply catches fire in Europe... growth is going to take off and crash the bond markets."

Upon further review, the Aug 27th ECB M1 release YOY% delta increase in monetary supply showed no increase over its average. However, it appears that ECB QE is having the same contractionary side effect on Euroland as it did on the US. Transaction turnover took a 2nd consecutive major MoM hit, declining from 92B to 65B to 37B. The Fed would raise?

And now, along with Mr. Peabody and Sherman, we step into the WABAC machine and set the dials for Dec 12, 2012, destination the Eccles Building, Washington D.C....

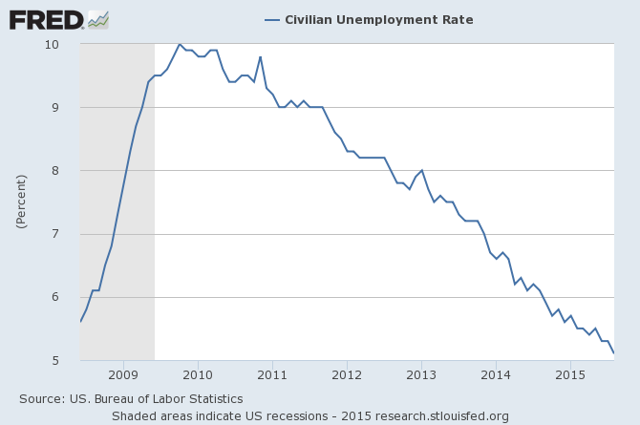

"The Federal Reserve on Wednesday agreed to keep a key short-term rate near zero until the 7.7% unemployment rate is 6.5% or lower. The short-term rate will also stay unchanged at 0.25%, the Fed said, until the current 2.2% inflation pace hits 2.5%. Tying the one rate it controls to unemployment and inflation targets is unprecedented, economists said." - USA TodayNote this economic projections release from that day, with FED expectations that the 6.5% unemployment mark and the core PCE 2.2% inflation marks would not be breached until mid to late 2015.

(click to enlarge)

Back to the future... above note, current advertised unemployment just hit 5.1% and breached 6.5% in April 2014.

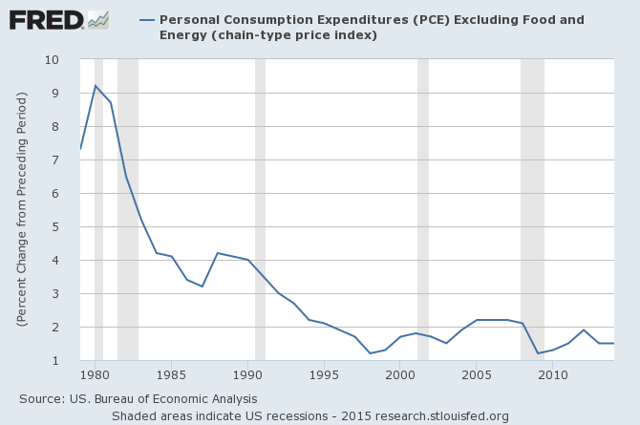

"Over time, a higher inflation rate would reduce the public's ability to make accurate longer-term economic and financial decisions. On the other hand, a lower inflation rate would be associated with an elevated probability of falling into deflation, which means prices and perhaps wages, on average, are falling--a phenomenon associated with very weak economic conditions."The above FED statement is in regard to the annual Yoy % Roc (rate of change or delta) in PCE inflation annually INDEXED excluding food and energy. Below, note as measured by the Fed...

(click to enlarge)

So it would appear that according to the FED, we have had very weak economic conditions since at least 1998. Below, note as measured by the Yoy % Roc in PCE expenditure excluding food the energy....

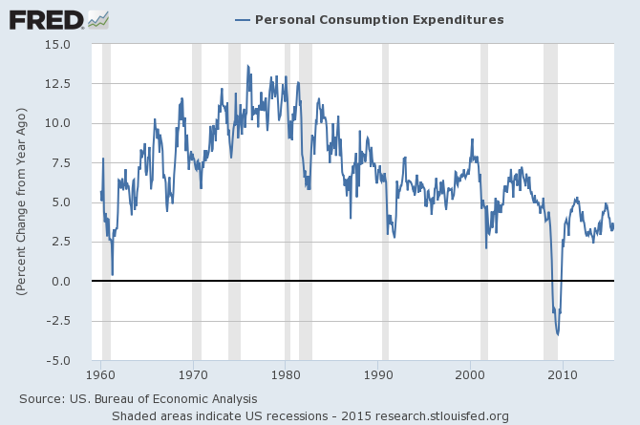

(click to enlarge)

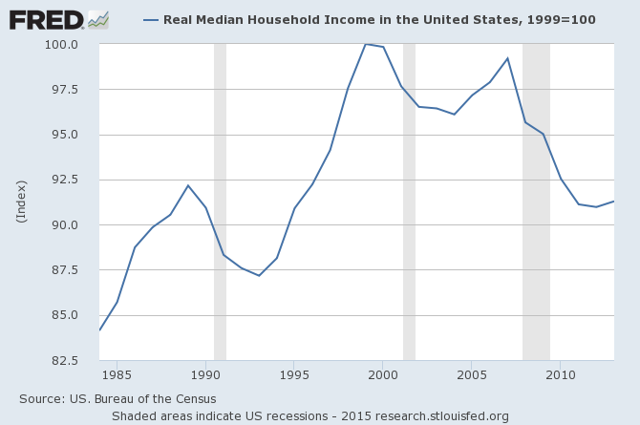

Since 1998, not exactly a model of economic growth with the Yoy % Roc being well over 2.5% since Jan 2010. Below note, concomitant since 1998, real household income has declined 9%.

Painful coincidence? We think not.

(click to enlarge)

Why does the economy refuse to improve? Whats all this secular stagnation of media narrative? Why has US real household income declined 8% since 1999? The banks are no longer in the lending business, they are in the saving business. Fed paid IOER induced disintermediation for non banks. Prior to Oct 2008 non banks (financial intermediaries, MSB, S&L, CU), comprised 82% of credit market lending, with the introduction of monetary policy paying them not to lend, this destroyed non bank lending and investing.

In QE, when a CB (central bank) buys their own bonds, they reduce the supply (float), raising the price, lowering the yields, and driving down rates. The money "created" electronically or money from circulation, to buy the bonds is parked on the sidelines.

Concomitant, when real rates are made negative via ZIRP, this creates a self reinforcing loop. In a flight to safety and search for yield, more money which was in circulation and could be invested as capital in productive economic enterprise, becomes subverted and sequestered in risk free assets (UST's), artificially suppressing rates and the rate of turnover or velocity of the monetary supply.

What do QE, ZIRP and IOER have in common? They are monetary policies which siphon off market liquidity (cash and assets with moneyness); artificially suppress interest rates and monetary flows (the pulse of the economy); subvert the flow of capital (the life blood of the system) to non productive (non PCE & non GDP) activity; and contrary to Keynesian dogma based upon false doctrine; are contractionary in nature to the economy. - Random NatteringThree decades ago, Stephen Hawking declared that a "theory of everything", one eloquent equation transcending all scientific disciplines and explaining all the mysteries of life and the universe, was on the horizon with a 50% chance of its completion by 2000. Now it is 2015, and Hawking has given up.

On the same note, for decades Keynesian doctrine has insisted in the existence of an equilibrium interest rate over a whole economy. Much like Hawking's "theory of everything", this theory has yet to be realized in practice and perhaps should be given up.

FFR (fed funds rate) is a tool for anchoring public and market expectations, not necessarily realizing mandate potentials. To wit, IOER (interest on excess reserves) and RRP (reverse repo) are far more potent tools for raising rates.Using the FFR as a guide in executing monetary policy is based on the absurd belief that there is at any given time, a policy rate which is consonant with the proper level and rate of growth of bank credit and the money supply. This false Keynesian premise (that interest is the price of money, not the price of loan-funds), combined with the lagged method of calculating bank legal reserves enables bankers to act on the valid premise that they can make, and keep, any loan commitment, knowing that their legal reserve requirements will be accommodated by the Fed. - Salmo Trutta

Raising FFR will not reverse the contractionary economic affect or effects of IOER (bank disintermediation, interest rate and monetary transactions velocity suppression) and RRP (the overnight price of all collateral parked at the Fed, dwarfing FFR in dollar volume at 10 to 1 on average).

All three tools will have to be utilized in the Fed's unwinding of multiple doses of QE. To counter QEZIRPIOER effects, the main goals should be an overall yield curve increase, steepening, and a reincentivizing of banks being in the lending business, rather than the savings business, through a reduction in the IOER and RRP arbitrage or carry trade. And yes, whether the Fed raises FFR or not, there would be pain. How much pain?

A conundrum of sorts, wouldn't you say? More to come, as in all the ugly and gory details, in the final act of, A Fed Raise Conundrum, How Much Pain? Stay tuned, no flippin.

Investing is an inherently risky activity, and investors must always be prepared to potentially lose some or all of an investment's value. Past performance is, of course, no guarantee of future results.

Before investing, investors should consider carefully the investment objectives, risks, charges and expenses of an investment vehicle. This and other important information is contained in the prospectus and summary prospectus, which can be obtained from the principal or a financial advisor. Prospective investors should read the prospectus carefully before investing.

0 comments:

Publicar un comentario