by: Hebba Investments

Jul. 20, 2015 2:15 AM ET

Summary

- On Sunday July 19th gold "flash-crashed" by over 4% in the span of a minute as $2.7 billion in notional gold was sold.

- No long would dump that large of a position in such a short timeframe, this was done to spook existing longs to sell contracts.

- Chinese physical gold demand has picked up significantly over the past two weeks and that may have been causing worry for shorts.

- This particular sale occurred right before the Chinese market opened and we speculate it may have been done to spook Chinese gold buyers.

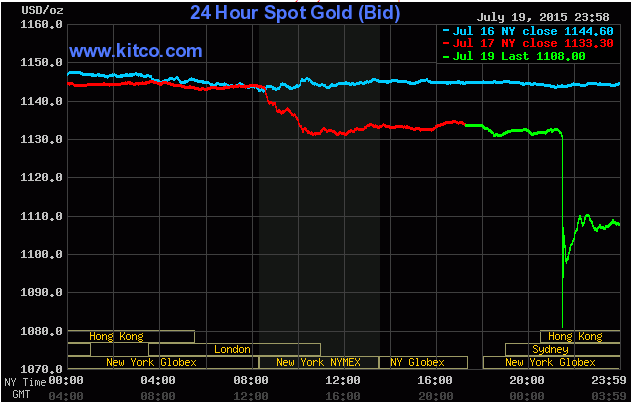

On Sunday July 19th, 2015, gold "flash-crashed" a little before 9:30pm EST, which is right before the time the Chinese markets open. Anybody looking at their screen would have witnessed a drop of around $50 or 4.2% - in less than a minute!

The chart below shows the crash in all its glory:

Source: Kitco

This gold dump was caused by a massive order to sell $2.7 billion dollars of gold contracts in the span of microseconds - that's how you get a 4.2% drop in one of the most heavily traded commodities in the world. This is not the first time we have seen this in the gold market, but this was the most obvious "dump" that we've seen since January 2014's gold "flash crash" - which was much smaller than this sale.

Of course any tremendous sale of gold contracts would be interesting to those following the gold market, but we think this particular event offers gold investors a number of important takeaways. Those making this massive sale didn't intend to do it, but for the card players out there - they have showed their hand and here's what we have learned.

Gold Has A Few Large Players Trying To Push It Down

Much of the financial media has it all wrong when they suggest that gold has "lost investor interest".

Of course interest is down from the 2011 all-time gold price highs, but many indicators of interest are actually up over last year and certainly higher than earlier this year. In fact the most recent data from Switzerland (the center for physical gold flows) show gold transfers are 10% higher year-over-year, July's US Mint gold bullion sales are the most since April 2013, the latest Commitment of trader report shows gold open interest has increased for a SEVENTH straight week, Chinese Shanghai Gold Exchange withdrawals for the week ending July 10th were the eighth highest ever registering at a massive 62 tonnes, and the list goes on and on.

It is clear that physical AND paper gold demand (COTS is a report of gold futures and options contracts) has been picking up steam, and that means investors are certainly not forgetting about gold - their increasing positions on both the long and short side.

Coming back to the $2.7 billion dollar Sunday night gold sale, it should be obvious now to investors that gold interest has not been dropping and it seems that someone on the other side of the gold trade needed to scare out more longs. Why is that?

First, no trader who is trying to make money or an investor holding a long position simply dumps $2.7 billion dollars worth of gold IN UNDER A MINUTE - this obviously will cause the seller to receive a very low price for their gold. A good trader wanting to sell such a large position would sell it over time or off the market, and they would certainly wait until the heaviest traded hours - not the illiquid minutes right before the Chinese market opens.

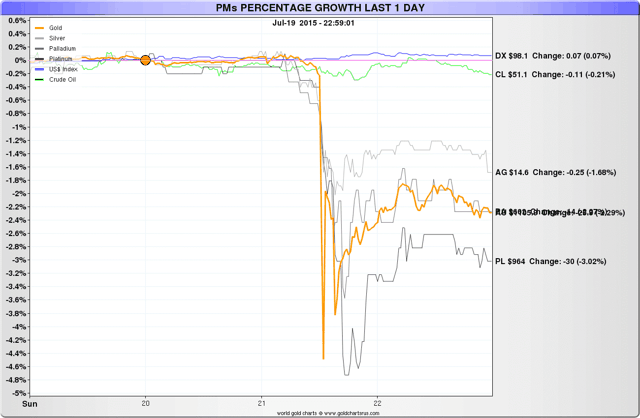

Secondly, there was no news of interest that would spook a gold long and that is why there was no reaction in base metals or currencies - only gold was affected with silver and platinum following suit minutes later as can be seen in the chart below.

This all means that this trade was done by a short seller that didn't care about the price they received - they wanted to spook the market. They also had big enough pockets to short gold with a nominal $2.7 billion dollars worth of trades - this is no little fish.

That is a KEY concept for investors to understand as this trader is trying to take advantage of investor emotions and not long investors throwing the towel on gold.

The Second Tell: Timing is Everything

The first concept should be pretty clear to gold investors, but it's the second one that is really important to grasp.

If you had $2.7 billion dollars that you wanted to use to short the gold price, why wait until right before the Chinese market opens? There are plenty of times that are even less liquid than that such as NY Globex or Sydney market open a few hours before. But this trader chose to dump their gold specifically before the Chinese market opened - that tells us that this trader wanted to spook Chinese gold investors so that trading began with a large decline in their gold positions.

We are not really clear on why, but if we had to guess it would be because this trader was concerned about Chinese gold demand and thus wanted to make a point to Chinese investors.

As we have stated earlier, Chinese demand was very strong in the latest reported week, and we can only imagine how strong it was last week as the gold price dropped further. If you have a large paper short position, the biggest fear that you have is that physical demand will cause a mismatch in the market and there won't be enough physical gold to sell.

Investors need to remember that it is very easy to sell $2.7 billion dollars worth of paper gold contracts (it can be done in a minute), but it is almost impossible to buy $2.7 billion dollars worth of gold in any sort of short timeframe. In fact, the largest paper gold market, the COMEX, only has around $500 million dollars worth of registered gold available for sale. So a trader can cover a $2.7 billion dollar gold position, but they cannot deliver that same amount of gold without a much larger timeframe.

That is why for those with large gold short positions, physical gold demand is so important for them to monitor and discourage. Where does the most physical gold demand come from?

China. Thus in our opinion it makes a lot of sense for a short-seller to try and "shock and awe" Chinese investors rather than Western gold buyers.

Conclusion for Investors

The important takeaways from this latest gold flash crash are:

1.- That there is an entity or entities trying to push the gold price down by massive gold sell orders

2.- The first and most obvious goal is to hunt for stop-losses and push gold longs to sell their gold positions

3.- The second goal is to try and change the Chinese gold buying mentality to be afraid of gold and to cut down on their physical demand

Not all investors are going to be able to play this game as emotions are very difficult to control, but on a more positive note for gold bulls, the more aggressive shorts get the closer we are to the end. Just like in 2011 gold longs got very aggressive and pushed the price up to over $1900 per ounce, gold shorts are now getting extremely aggressive and are led by some large pocketed shorts that are able to dump billions of dollars at a time.

The big question is will physical demand eventually overwhelm the gold shorts? We think so and the further and more violently gold goes down the greater the chance of "something breaking" and there being a paper-physical gold mismatch. But even without that, most miners cannot sustain operations at $1100 per ounce for any lengthy period of time, so over time gold production would plummet and patient investors in gold (miners are a different matter) would do just fine.

We are not discouraged by the gold rout as we think this is clearly psychological warfare being played out in markets and not a loss of fundamental demand, and if investors can be patient then they should do just fine as either the shorts will overdo their advantage OR gold production will plummet. Thus we continue to suggest investors increase positions in physical gold and the gold ETF's (SPDR Gold Shares (NYSEARCA:GLD), PHYS, CEF). For investors looking for higher leverage to the gold price, you have to be very careful here as miners do not have the ability to be very patient if their primary source of revenue drops in price and they are overloaded with debt. Thus investors need to be extremely choosy and make sure they understand the balance sheets of the miners they own.

0 comments:

Publicar un comentario