7 Reasons To Buy Gold Right Now

by: Epsilon

Jul. 19, 2015 1:06 AM ET

Summary

- Gold is trading at its lowest level since 2010.

- Gold has returned 10% annually averaged over the past ten years.

- It is recommended to hold some physical gold in your portfolio.

So for the past two years I really haven't paid much attention to gold. Then yesterday I took a look at the price of the yellow metal. It's low. Real low.

Say what you will about whether you think gold is going to continue to climb, fall, or trade sideways. If you're holding gold for the long term, and you should be, it's not worth speculating what the metal will do in the short term.

To the point, here's why you should own gold and why now is as good a time as any to buy.

1. Gold Crashed for a Reason

In April, 2013, gold crashed. And no one truly knows the intimate details of why. All most know is that a very large sell order was placed and, as a result, the gold market was frozen briefly and then gold subsequently began to fall. This was when gold was at the $1600+ level.

So why did gold crash? Ask ten people and you'll get ten different answers. All you need to know is: There was a reason.

Many firmly believe that gold prices are manipulated, somehow, some way. Whether they are or not is beyond the scope of my investigative powers. But what would happen if the United States government was suddenly in the market for gold? They'd want to buy it as cheap as they could. And what if they themselves had the power to suppress gold prices?

It's something to think about.

2. The United States Government Owes Germany (and Others) a Lot of Gold

There has been a lot of speculation surrounding the United States' gold holdings. After requests for audits, delivered reports, and plenty of speculation, we still don't know how much gold the United States holds. And of this gold, how much of it is actual property of the United States?

The United States holds gold for many countries. In January, 2013, one of these countries, Germany, asked for 674 tons of their gold back. The United States government didn't give it back. Instead, they promised to return the 674 tons of gold by 2020.

It's curious that gold crashed shortly after Germany asked for a large amount their precious metal back from the United States.

3. We're Off the Gold Standard So What is the Dollar Really Worth?

In 1971, Nixon agreed to take the United States off the gold standard. As a result of this, the United States Federal Reserve can now effectively print as much money as they want without having to back it with a physical asset.

Here's a little more detail: Before 1971, the United States dollar was backed by gold (i.e. the gold standard). So every dollar that was printed had to be backed by an actual, physical gold holding. If the United States wanted to print more money, they needed more gold.

After August, 1971, this all changed. And as you can imagine, this is potentially a very scary thing. What's to stop the United States from printing more and more money? A lot of things, surely. But leaving the gold standard certainly takes us one giant step closer to runaway inflation and, potentially, significant economic chaos if our currency isn't strictly regulated.

4. Gold Will Always Be Worth Something

So we're off the gold standard and now you're paranoid that the dollar may continue to be worth less and less. Who knows? Maybe the dollar will collapse someday.

I doubt, and truly hope, I don't see a collapse of the dollar in my lifetime, but it's certainly worth thinking about. If this concerns you, remember that gold is an extremely rare and precious metal, one that has been coveted and collected throughout history. It has always held value.

5. There is a Limited Supply of Gold

It is estimated that all the gold currently above ground could fit in an area the size of a tennis court, 30 feet high. It is a limited very resource.

6. Gold Averages a Better Return than the S&P 500

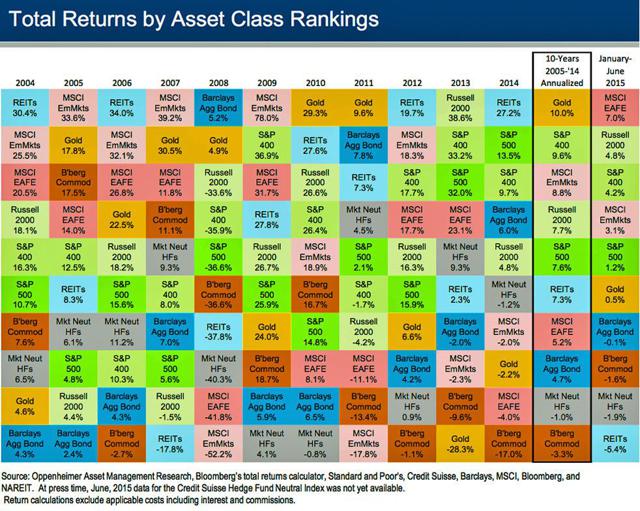

Over the past ten years, gold has averaged a 10% return (annually). In the same ten years, the S&P 500 (NYSEARCA:SPY) has averaged a 7.6% return (annually). The graph below, from Jeff Dejardins' article, "The Historical Returns by Asset Class Over the Last Decade", show that, not only has gold outperformed the S&P 500 over the past ten years, it has also outperformed all other asset classes listed in his analysis.

(click to enlarge)

7. Gold is Cheap Right Now

Gold closed at $1,133.58 per ounce on Friday, July 17th, 2015. It hasn't been this low since 2010. (For perspective, gold's high was $1889.70 per ounce in 2011.)

Gold is very inexpensive at present. If you know you want to buy something, you generally want to get it for the lowest price. If you want gold, it's on sale.

(click to enlarge)

For those interested in purchasing gold, a good place to start is your local coin and jewelry shop. If supply is an issue there, online purchasing is also an option. I generally like to purchase the most popularly traded forms of gold, gold eagles or gold buffalos. Another option is the new Valcambi gold CombiBar™. They sell for a premium but the bars are designed to fit in your wallet and be used as a currency by breaking off into one gram pieces.

0 comments:

Publicar un comentario