by: Economics Fanatic

Jan. 15, 2015 5:32 AM ET

Summary

- Gold is unlikely to rally in the first half of 2015 and the outlook for the second half of 2015 is still murky.

- Only QE4 can trigger a 30% or higher rally in gold and I don't see that coming in the next 2 quarters.

- The dollar will remain strong in the coming 2 quarters and this will keep gold sideways or lower.

- My view is to gradually accumulate gold towards the second half of 2015. Gold mining companies also look interesting for 2H15.

Given the expectation that it is unlikely for equity indices to provide a 30% return, the returns prospects for gold is worth investigating. This article looks into the positive and negative triggers for gold and concludes on the probability of a 30% rally in the precious metal for 2015.

Before discussing the main story, I want to mention here that I am bullish on gold with a 3-5 year investment horizon and my opinion is to accumulate the precious metal at these levels for investors who are not bothered about another 5% to 10% fluctuation in the near-term either ways.

Scenario Where A 30% Rally Is Unlikely

If the US economy remains resilient through 2015, a 30% rally in gold can be ruled out. The dollar index has surged from 79 in May 2015 to current levels of 92.2. The rally in the dollar has been backed by a strong US economy and a strong dollar is negative for gold.

It is important to mention that the risk in other economies globally such as China and Euro-zone is also likely to trigger demand for safe asset classes. However, the money is currently flowing into US Treasuries and not gold. US Treasury yield (10-year) have declined to 1.84% from 2.51% at the end of the third quarter of 2014.

Further, if the US economy remains resilient, there will be a continued flow of funds towards US equities besides Treasuries. It is therefore unlikely that gold will witness strong demand as long as the dollar remains strong.

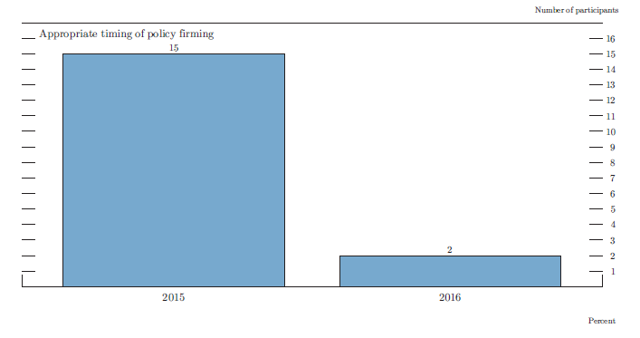

I must also add here that a majority of the FOMC participants expect an increase in interest rates in 2015.

(click to enlarge)

If interest rates do increase in the first half of 2015 or in 2015, gold is unlikely to surge higher. On the contrary, in a scenario of interest rate increase, I expect gold to move lower by another 5% to 10%.

However, I have my doubts on a potential interest rate increase in 2015. I had discussed the reasons for believing that there will be no interest rate hike in 2015 in another of my recent articles.

Leaving aside my opinion, most FOMC participants and economist see an interest rate hike in 2015 and that will ensure that the bearish near-term momentum for gold sustains.

Scenario Where A 30% Rally Is Likely

For December 2014, the retail sales plunged by 0.9% and it came as a surprise for the markets. While equities declined, there was further rally in Treasuries. The important point to note here is that the retail sales plunge was primarily due to cheap gasoline. However, with the festive season over, the real test for the US consumption will be for the coming months.

Decline in consumption in the coming months can trigger downside for equities and further rally in the dollar. Also, if the decline in US economic activity is accelerated by sluggish economic activity in other developed markets, a global recession can be on the cards in 2015.

I must also add here that the US shale boom has contributed to the GDP as well as job growth. The impact of sustained lower oil prices on investment decline in the sector coupled with job losses remains to be seen. It can potentially impact the job scenario.

If the US economy goes through these headwinds in the coming months, the implication will be as follows -

- The dollar will get stronger while the economy will get weak

- The rally in Treasuries will continue while US equities will trend lower

The Scenario Likely To Pan Out

I am of the view that the US economy will remain resilient in the first half of 2014. In my opinion, the recent decline in retail sales has been primarily due to gasoline prices as holiday sales for December 2014 was higher by 4%. The December 2014 employment report also points to a positive outlook for the economy and the job market in the coming months.

Therefore, I don't see the prospects of the US economy dwindling in the first half of 2015. In other words, I expect gold to move sideways to lower in the first half of the year. I must add here that expansionary monetary policies are very likely in the Euro-zone in the coming months. This will support global liquidity and will keep sentiments positive for US equities.

I must also add here that the US adjusted monetary base has been trending higher in the recent past after a sharp decline following the end of QE3. Therefore, US monetary policies are certainly not very restrictive at this point of time and it will continue to provide some support to the economy in the coming months.

For the second half of 2015, the outlook is murkier in my opinion and I believe that any rally in gold is only likely to come in the second half of the year. A lot will depend on how the global economy shapes up and its impact on the US economy. As mentioned earlier, there will be more clarity on the impact of lower oil prices on the US economy (potential GDP decline from sluggish shale activity).

Therefore, my view is as follows -

- Overweight on US equities and Treasuries for the first half of 2015

- Consider accumulating gold towards the second half of 2015

Conclusion

In conclusion, I believe there investors need not rush towards exposure to gold as there are no big triggers for gold upside in the immediate term. However, after the first half of 2015, investors need to gradually accumulate the precious metal.

The best idea is to consider exposure to physical gold as that is always better than gold ETFs (NYSEARCA:GLD). However, investors can also consider exposure to gold mining stocks as their upside and dividends directly depend on gold prices.

I would recommend Newmont Mining (NYSE:NEM) and Barrick Gold (NYSE:ABX). Both these companies have done well in terms of control in all in sustaining cost in difficult times and I believe that the companies will show strong profits once gold price move higher.

0 comments:

Publicar un comentario