by: Andrew Hecht

Dec. 8, 2014 6:01 AM ET

.

Summary

- Bears were looking good, then...

- Bulls were looking good, then...

- The dollar holds the key.

- Where is gold going?

All precious metals, which were down in sympathy with oil prices in post-OPEC meeting selling on Friday, November 28, continued to slide. In early trading Sunday night, gold dropped like a rock. The price swooned to $1141.70 - only $11.30 above the recent lows. Gold fell so quickly it looked like it was going to move through those lows like a hot knife through butter. At the same time silver looked even worse, falling to $14.155, the lowest price since August 2009. Platinum also fell, its price reaching $1182.80, just $5.30 below recent lows. The gold bulls stepped aside while the bears cheered.

Bears were looking good, then...

As I went to sleep Sunday night, it seemed that I would wake up to see precious metals markets reeling. However, a funny thing happened on the way to the abyss. India announced that they were removing import restrictions on gold and that ignited the price of precious metals. Monday, in one of the busiest, high-volume days in quite some time in precious metals, gold, silver and platinum exploded. Gold traded all the way up to a high of $1221 -$79.30 higher. Platinum traded up to $1247.70 - a rally of $64.90 in one trading session. The most incredible performer was silver, which moved from the lows to a high of $16.81 - $2.655 or a mind-blowing 18.76% higher in a matter of hours. As the bears scrambled and wondered what was going on, the bulls cheered; they were once again in control. Patience paid off and it appeared that an important bottom was in place with higher prices on the horizon.

Technically, gold, silver and platinum all looked set to make a statement. On weekly charts, all that was necessary for a bullish key-reversal was a close above $1203.80 on gold, $1231.40 in platinum and $16.69 in silver. A bullish key-reversal on a weekly chart is an important event, but in all three major precious metals? Surely that would send a signal that the bear market was ending and higher prices were a given. On Thursday, December 4, gold settled at $1207.70 and platinum at $1245.90 - both above the level needed for a key reversal on the weekly chart. Meanwhile, silver settled at $16.575 - a stone's throw away from the all-important $16.69 level.

Bulls were looking good, then...

Gold moved down $15 to $1192.60, platinum to $1223.60 down $22.30 and silver finished the week at $16.285, down 29 cents on Friday. Dreams of bullish key reversals on weekly charts vanished as the market pulled the rug out from under the bulls. It was a week of tears in the three precious metals markets. The bears wept early in the week and the bulls late, as the markets failed just short of making major technical statements.

(click to enlarge)

A bullish key reversal on the weekly gold chart depended on a close above $1203.80 on Friday, December 5 - the yellow metal could not do it.

(click to enlarge)

Silver closed Friday, December 5 at $16.285 - shy of the $16.69 needed for a bullish key reversal on the weekly chart.

(click to enlarge)

Finally, platinum needed to close above $1231.40 for the technically bullish signal, but could only manage to finish at $1223.60.

The potential for a triple bullish signal in precious metals went up in smoke on Friday as another market, a paper currency, made a new high. On Friday, December 5, the dollar rallied to new highs, settling above the June 2010 resistance.

The dollar holds the key...

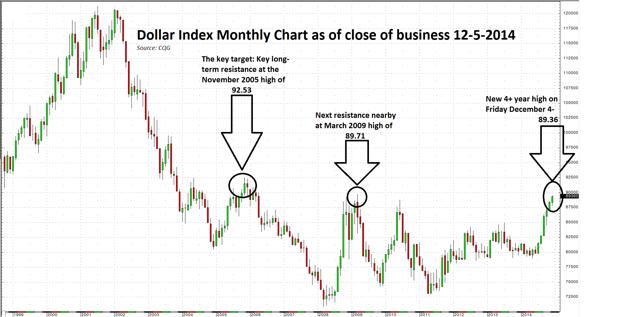

The US dollar continues on a tear. When compared to the euro and the overall European economy, the dollar is golden. Since May 8, 2014, the dollar index has moved from 79.24 to 89.36 - an increase of 12.77% in seven months. While this type of move is commonplace in the world of commodities, it certainly is out of the ordinary in a currency. The dollar is in bull mode and there seems to be nothing that can stop it.

(click to enlarge)

The dollar is now in strong resistance zone. There is resistance at 89.71, the March 2009 highs. However, the real target for the greenback is the November 2005 high of 92.53. Above that level, watch out - on a technical basis, the dollar can really fly.

There is an inverse correlation between the value of the US dollar and commodity prices. Since the beginning of the dollar rally this past May, that relationship has held. The dollar has strengthened and commodity prices have gone down; in some cases, they collapsed.

If you believe the trend is your friend, then the dollar is likely to keep moving higher. Not only does it have technical momentum as a tailwind, but also fundamentals do not look bad either.

Strength in the US economy means that interest rates are likely to rise in the future. Weakness in Europe means that interest rates will stay low. Current interest rate differentials between European sovereign debt and US debt favors the dollar - if the spreads widen with US rates rising, then watch out, demand for dollars will explode. Economic data on Friday certainly supports that theory, while Europe's economy languishes; the US experienced the biggest payroll gain in almost three years.

Where is gold going?

Conventional wisdom points lower. However, that is the easy answer. The real question becomes, is the dollar so strong or is it just the strongest fiat currency today, in a world of paper currencies backed only by the full faith and credit of the governments that print that paper? The answer to that question will determine the future direction of the yellow metal. Do not forget, gold has been a currency or a means of exchange for long before any of the paper currencies out there today existed.

The Swiss in a landslide result voted down gold's role as a currency on November 30. However, the market will make the final determination of gold's value relative to the currencies of the world. In the meantime and for the balance of 2014, I suspect that the epic battle between gold bulls and bears will continue. That may mean that gold will close right around current levels and unchanged for the year.

0 comments:

Publicar un comentario