The Gold Bull Market Is Not Over

Summary

- Gold has been out of favor for the last few years but the bull market is not over.

- Our problems here in the US are not fixed and behind us, as the debt and deficits are about to explode higher.

- As interest rates increase, the net interest payments on the US debt will triple by 2024.

- Inflation is the only way that we can get out of the mess we are in.

With gold still trying to decide whether it wants to put in a triple bottom or have one final plunge lower, it's important for investors to realize that either way this bull market is not over. Gold has been out of favor for the last few years as easy money from the Fed and other Central Banks has caused investors to run for stocks instead of to the safety of precious metals. Which is ironic since the precious metal sector is the one that will benefit in the end from all of this printing of worldwide currencies.

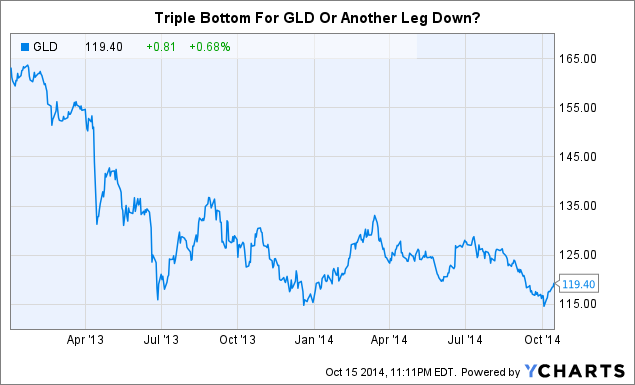

Below is a look at the SPDR Gold Trust (NYSEARCA:GLD). The 115 level is key and you can see that it bounced off of that level earlier this month. If 115 is breached then I expect 90-100 to be the final bottom.

GLD data by YCharts

I have read so many articles about how gold is a lousy investment and its run is over with. It's easy to say those things when the Dow, Nasdaq, and S&P have almost doubled over the last 3 years while gold has declined from $1,900 down to $1,200. Investors chase returns, and the majority are always late to the party, never early. When an investment sector is down, and you try and say anything positive about it, not many people are going to pay attention. That's not where the action is. But the point of investing is to get in front of the next big thing and ride it all the way.

Those who think this gold bull that started in 2000 is now over don't understand that fundamentally nothing has changed. If anything we are on an even worse path than we were 10-15 years ago. There is no way out of the hole we have dug, and just because the major indices are rising (or at least were rising) and gold is falling, doesn't mean that our problems are fixed and behind us. There is nothing in the rear view mirror yet. Everything is in front of us and we are heading straight for it.

This isn't a doom and gloom article. I'm not bearish on the US over the long-term, I am however bearish on the US Dollar and almost every other major currency out there.

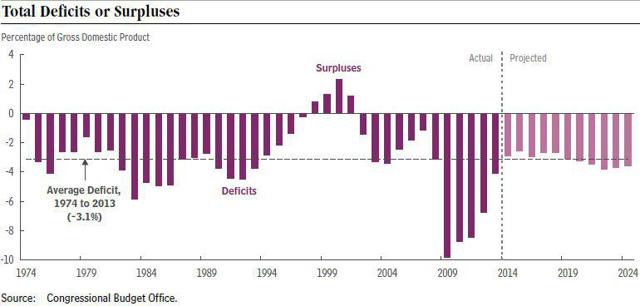

Below is a look at the total US deficits or surpluses for the last 40 years, plus the projected 10 year outlook. 36 out of the last 40 years we have had a deficit, and these aren't small deficits either. The average is -3.1% of GDP, but we hit some big numbers in the last 5 years. If you look at the projected figures from the Congressional Budget Office for the next 10 years, the US will stay close to the average. I can tell you though that rarely are the CBO's projections accurate when it comes to GDP as they usually over-estimate growth. In other words, the projected deficits are probably going to be worse than displayed below.

(click to enlarge)

(Source: CBO)

When you think about it, by 2024 the US will have had a deficit for almost every year for the last 50 years. That little blip in the late 90's/early 2000's into a surplus is just that, a blip. There is only so much that a government can spend before the public says no more. And we are nearing that point.

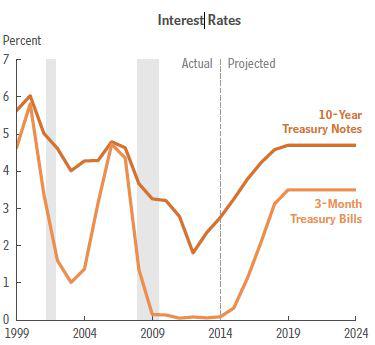

Outlays for net interest in 2024 are projected to be more than triple those in 2014. In 2014 the net interest will be $231 billion, by 2024 it will be $799 billion. This increase in interest payments is the result of both projected growth of the US debt and a rise in interest rates. If you look at the graph below, you will see that net interest payments will make up the majority of our total deficit. By 2022, we will be running almost $1 trillion deficits per year, and that is with 2.1% real GDP growth (or 4.2% nominal) factored in.

(click to enlarge)

(Source: CBO)

The Fed is saying it's going to raise rates soon as growth picks up, but when it does it's going to trigger an avalanche of many bad events. Interest on the US debt will increase, and if we have below average growth then that means the debt is going to keep piling up at an even faster clip.

Things will get worse, not better. The interest and debt will just start feeding off of each other and then things get out of control. We are nearing that point, all that needs to happen are for interest rates to increase.

By 2024, the projected rate on the 3-Month Treasury Bill will be 3.4%, and the 10-Year will be at 4.7%. The majority of US debt is held in 10-Year Treasury Notes, and right now the average rate that the US is paying on those is 1.8%. The US Government is benefiting more than anybody from these low interest rates.

(Source: CBO)

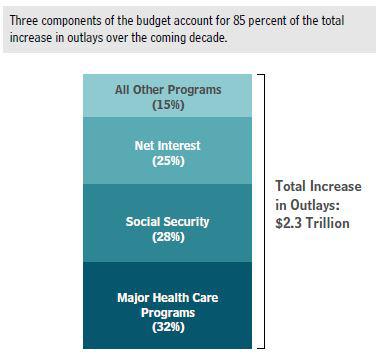

The US Government has tried to cut spending to lower the rate at which we are adding to the debt, but we are now to the point where any reductions are more than cancelled out by increased outlays for Medicare, Social Security, and Net Interest. Those account for 85% of the total projected increase between now and 2024. The $2.3 trillion increase in outlays over the next 10 years might not seem like much, but between now and 2024, over $7 trillion will be added to our debt because of this.

(Source: CBO)

Gold is out of favor at the moment but nothing has changed in terms of how well it is going to perform over the next decade. We have no way out of our problems but to inflate. Most people don't realize that. The Fed needs to keep the Fed Funds rate below the rate of inflation as by doing so keeps this negative real interest rate environment intact. And gold loves negative real interest rates. As long as the rate of inflation exceeds the interest we are paying, then we can inflate our way out of this mess. Things will be very out of control at that time in the currency market, but if we don't inflate then we simply default on our debt. This isn't conjecture to try and scare people, this is really going to happen.

Everything I have presented is fact. The debt, the deficits, the interest payments, the interest payment increases, etc.. Those running to stocks and shunning gold are ignoring those facts, and in the end they are going to wish they had been paying more attention.

Things might seem calm again but they are far from it. Any increase in interests rates will start everything back in motion. Gold will find a bottom very soon, if it hasn't already, and then it will continue its bull market

0 comments:

Publicar un comentario