How Far The Gold Sell-Off Could Go, And Strategies That'll Save You

Apr. 17, 2014 11:25 AM ET

by: Jeffrey Dow Jones

.

Summary

- $800/oz. That's how low gold could go. No joke.

- Gold is still tremendously overvalued relative to its fundamental trend, masked by what is slowly being accepted as a bubble in 2011.

- Regardless of which direction gold goes from here, there are strategies that are vastly superior to buying and holding.

- A basic trend-following approach has generated almost double the return of gold with less volatility.

"Gold is religion."

You either believe or you don't believe. That belief comes in different flavors and denominations, and it's what makes the marketplace so colorful.

There's a spectrum of faith, as well. Not all of us go to church every Sunday. Some of us just dabble. And like any other religion, the folks at either pole can be a bit of a challenge to deal with. The best that those of us in the middle can do is admire the passion and conviction, while listening with respect.

Perhaps most like religions, when you get down to the bottom of it, there's very little mind changing with gold. This is totally cool. There's nothing wrong with this. Plenty of believers and non-believers have made money at various times over the years. The one thing that both camps have in common is that neither really knows what's going to happen in the future.

What I've tried to do with these articles on gold is step away from the core tenets of each of those belief systems. My goal is to build a fact-based foundation, and establish a set of common principles that both camps can agree on. In a lot of ways, all I'm really doing here is acting as the couples therapist; "let's focus on where our feelings overlap and see where that takes us."

Understanding the Drivers

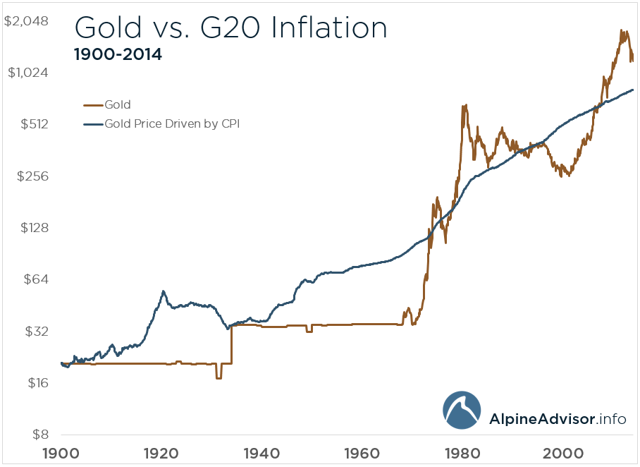

The first thing we did was take a look at the history of gold and identify the one variable that is responsible for virtually all of its long-term movement:

inflation. Specifically, global inflation.

Everybody in both camps agrees with this. Gold is a global market, and as something of a "neutral currency" and "store of value", gold's price over time is linked to the value of the currencies in which it is denominated. This is true by definition.

Obviously, there are all sorts of short-term psychological- and momentum-based factors at play with gold. The price of gold may go up at the same rate as inflation over the long run (it has to), but during any given year or even during any given decade, prices can be all over the map. This is another point on which everyone can agree.

From that foundation, we can go back and start relating the gold price to its historical inflation-based trend. It's a really interesting model, and there shouldn't be too much controversy about it. All this does is track the current market price of gold and what the price of gold should be as the currencies in which it is denominated slowly get less valuable over time.

(click to enlarge)

The orange line is the gold price, and the blue price is basically the inverse of the dollar (or a basket of G20 currencies after 1996).

You'll notice several remarkable coincidences, the first occurring in 1934 as the price of gold was re-pegged to $35/oz. That was exactly what the price should have been, had it simply been allowed to float in accordance with the inflation rate.

Then, in the early 1970s as the U.S. began moving away from the gold standard, gold started to trade freely in the marketplace. And once again, remarkably, the valuation almost immediately shot to exactly where it should have been, had the gold price simply been allowed to float in accordance with the inflation rate. Gold and an "inverse dollar" met once again, just as one would have expected.

Gold is frequently thought of as an inflation hedge, and after the adjustments of 1934 or 1974, and again as recently as 1996 or 2005, gold was a perfect hedge against inflation.

Remarkable, isn't it?

You can see how beautifully these lines track, because technically, they're inseparable from one another. Inflation, the value of a dollar over time, is the chain about which gold's shiny ball, an asset that doesn't really deplete or do much else aside from store wealth, is inextricably and unavoidably linked.

In case you were curious, this type of model suggests a fair price for gold of around $812/oz.

I realize that's a controversial conclusion. It's just a simple extension of the principals we all initially agreed with, though. I understand that $800/oz feels really far away, but consider we were just there in late 2007. The pre-crisis stock market valuations didn't seem so unreachable. For some reason, gold's pre-crisis valuation seems impossible even to the Gold Atheists.

Projecting Future Returns

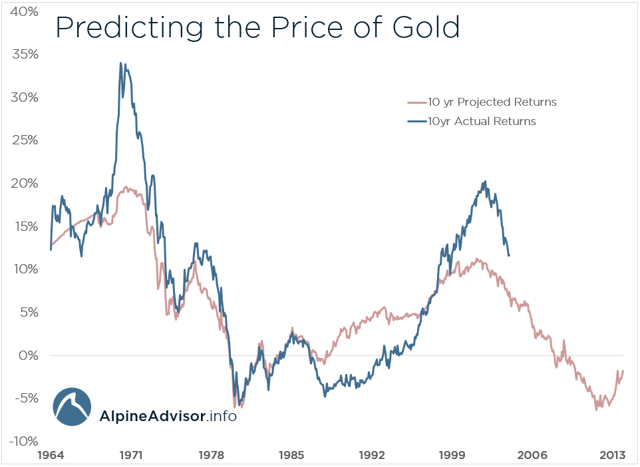

The next thing we did was feed that into a very basic model that attempts to project the future returns of gold. These types of models are not uncommon throughout the industry, and over the long run, the structure tends to work fairly well, as long as you understand the fundamental trend driver. Future returns are, by definition, a function of:- The basic fundamental trend.

- Long-term mean reversion toward that trend from current valuations.

- Some psychology and momentum (which evens out over long windows of time).

(click to enlarge)

It's not perfect, and it gets the exact details wrong from time to time. But generally, it's helpful enough. Most importantly, it's really good at picking out the moments when prices get extreme relative to the historical trend.

I think that's another thing we can all agree on. We all agree that gold was massively undervalued before the U.S. started relaxing the gold standard in the early 70s. We all agree that gold was way too expensive during the bubble in 1980. And we all agree that gold was massively undervalued again in 2001.

Where the Arguments Begin

The problem is what this model says about 2011. In 2011, this model was suggesting that gold was massively overvalued. Relative to its long-term trend, gold was almost as overvalued in 2011 as it was in 1980. We don't have a full decade of forward returns yet, so it's unclear exactly how bad a point that was at which to establish a long-term gold position, or even if it'll be a bad point at all.

Nobody in either camp can say for sure.

But gold's off to a pretty miserable start since this model suggested that moment of extreme overvaluation. Gold is down nearly 40% in the three years since the peak. Again, anything could happen in the next seven years. Gold may go to $5,000/oz by 2021, and our 10-year forward returns may wind up as positive.

Who really knows? Every religion requires a certain degree of faith.

The point -- and this is another point everybody will agree on -- is that in order for a major, continued advance to occur, it will be contingent upon future events. Unexpectedly high inflation or a global currency collapse, for example.

Some of us are more comfortable forecasting that and investing around that thesis than others.

Let's Build Some Strategies

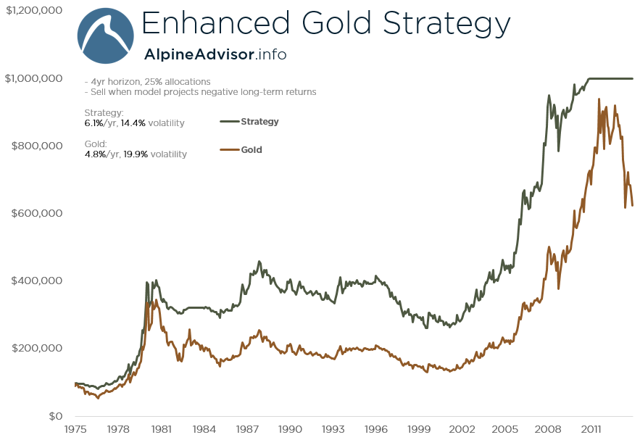

The first thing we can do is assemble a simple rotational strategy where we're always long gold, but slowly get out when it's much too expensive. (More details here.)

That strategy looks like this:

(click to enlarge)

We can improve on that somewhat by matching our holding period to our projection period (10 portfolio buckets with a 10-year window for each), and putting the cash that's not in gold to work in something short-term and zero-risk like the Fed Funds rate.

That looks like this:

(click to enlarge)

This stupidly simple approach is vastly superior to buying and holding gold. All it does is slowly get you less long when valuations get extreme, and get you more long as valuations improve.

There is no debating the results here. This has been a better way to invest in gold. It's better to step aside or invest less during moments of extreme overvaluation. It's better to be more invested when valuations get cheap. If you can spot those moments of extremity, you should act accordingly. And like I said, if this type of model can do one thing -- and I actually don't have confidence it can do much else -- it's that it can tell you when gold is extremely overvalued relative to trend.

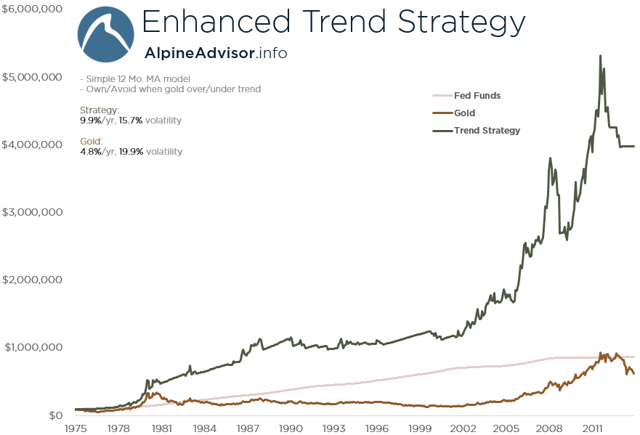

How To Do Even Better

Rather than messing around with trying to figure out whether gold is historically expensive or cheap, we can just use a medium-term trend-following approach. If gold is above its 12-month moving average, we own it. If it's below, we sit in Bills or Fed Funds cash, or if we're, ahem, concerned about inflation, then we can sit in short-term TIPS.

Here's how that strategy looks:

(click to enlarge)

Crazy, right?

No matter what you believe, a purely mechanical trend-following approach blows our original strategies out of the water. In terms of total return, buy-and-hold-gold is a joke.

The only problem with that these days -- and this is a legit criticism, too -- is that while in the past you could move your portfolio to cash or T-Bills and get a fair return, you can't do that anymore. Bernanke took that away from the market.

Today: Inflation > Short-Term Yields

That kind of environment is very rare in history, and it's a theoretically optimal environment for gold. But as the last three years have demonstrated, current valuations do matter, and gold is no guarantee to preserve wealth in an environment of negative real yields. Even with short-term yields below the inflation rate, you would have been much better off in cash than gold in recent years.

I also might submit that after things started breaking down in late 2007, the gold market sniffed this out and knew that we were headed for negative real yields at the short end of the curve. I haven't a clue how to prove such a thing, but this may have been an interesting accelerant for gold in the 2008-2011 years. Eventually, valuations got too crazy, and the trend, like every trend in every market in history, finally broke and went back the other way.

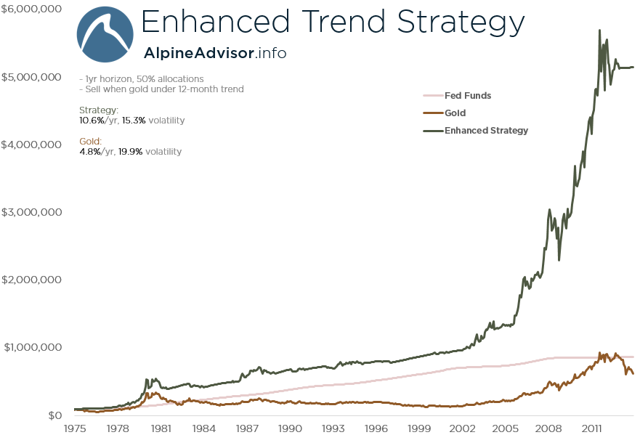

Back to our strategy-building, if you don't want to constantly follow gold's current price and moving average, you can be lazy about it.

You can split your portfolio in half. Every January, take a look at the current price. If it's above the 12-mo moving average, you buy with that half of the portfolio or stay long. If it's below, you sell. Then in July, you do the same thing for the other half. So rather than being ALL IN or ALL OUT at any given moment based on a dynamic moving average, our total portfolio may be 100% long, 50% long, or 0% long at any moment in time. We make a maximum of just two trades per year, so like I said, this is a lazy man's trend-following approach.

Here are the results:

(click to enlarge)

Wow.

Our lazy portfolio makes 10.6% per year to gold's 4.8%. And it does it with 15% volatility, instead of 19%.

You can do this with gold futures. You can do this with ETFs like SPDR Gold Trust (GLD) and iShares Gold Trust (IAU). Given the baggage and spreads that coins carry, you probably can't do this with the physical metal, but at least it might give you some insight on when it's a better or worse time to go down to the corner coin shop.

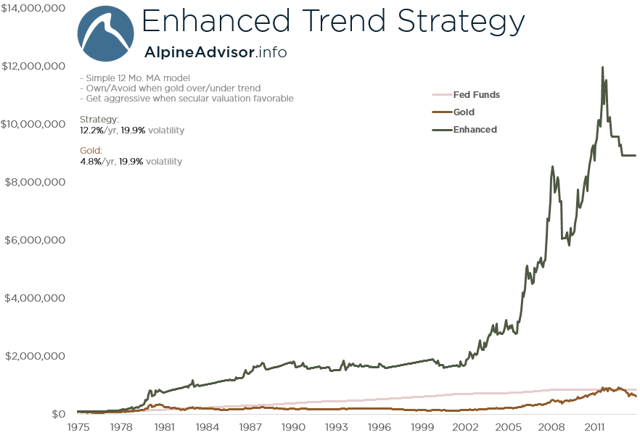

Let's Kick It Up A Notch

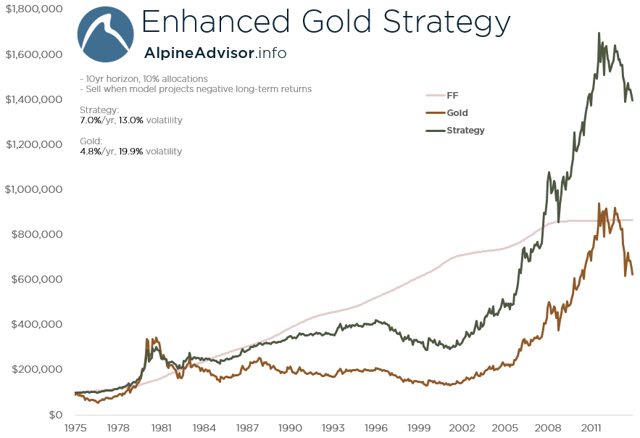

What happens if we use a simple 12-month trend-following strategy as our basis, and then, if gold is abnormally cheap on a secular basis, we get a little aggressive?

When gold gets historically cheap according our very long-term model, the tailwinds of mean reversion start picking up. You can see very clearly from the first chart that mean reversion, arguably, helped power the move in the late 70s, and again from 2001 to 2006. If you believe in the power of mean reversion, then you should be more aggressive with gold when it gets extremely undervalued relative to its trend.

The easiest way to define this would be to draw a line at a certain forward-return threshold. Projected 10-year returns greater than 5%, let's say. You could be aggressive with gold as long as the returns are above that, and switch back to a normal weight as the trend approaches fair value again. Since gold tends to move in very long cycles, and the nature of our projection -- 10-year expected returns -- is inherently a long one, you would want to give your strategy time to let that play out. We might loosely define that "out point" as a negative projected 10-year rate of return for gold. At that point, we'd turn off our aggressive modifier. Gold would, theoretically, have approached something of a fair value.

In this simple model, we can express that aggressiveness as a 1.5x leveraged position. I wouldn't suggest anybody actually execute this strategy in that way, but this will keep results consistent with our earlier strategies.

(click to enlarge)

Good lord.

12.2% per year, with essentially the same long-term volatility as gold. That's crazy. There's some hair-raising drawdowns, of course. But those are par for the course with gold.

If you don't like the idea of leverage (and with gold, I sure don't), you could think of having reached an extremely undervalued price as a condition as necessary for a 100% allocation. In other words, that would be the situation you'd need to be fully long gold. Unless the secular valuation was especially favorable, then your max gold position might be something like two-thirds.

Also keep in mind that this isn't really a long-term gold strategy for gold. It's fairly active, and there's a lot of buying and selling as gold moves above and below its 12-month moving average.

I realize that these are gigantic numbers. I'm sure if you started applying all sorts of arbitrary, fundamentally-unrelated signals, you could fit this curve to create even more gigantic numbers. I have no interest in drawing up some backwards-looking strategy to maximize returns. All I want to do is incorporate what we learned in the first two parts of this study (part one and part two) into designing a slight better strategy.

We're doing something that makes practical sense, and is defensible in theory. The idea is simply to be long gold when the short-term trend is bullish, and be aggressive when gold gets extremely undervalued relative to its long-term trend. Even if you had never seen any of the charts above, you might guess that that'd be a fairly sensible and profitable way to approach gold.

Strategy Recap

Strategy #1 For Active Traders

- Be long gold at all times when above its 12-month moving average.

- Sell immediately after a monthly close below the 12-mo SMA, and buy immediately after a monthly close above it.

- When the projected 10-year rate of return for gold rises above 5%, start getting aggressive. Use leverage, or move to a 100% allocation.

- Ride that trend until secular valuations become unfavorable again (<0% 10-year projection).

- When not long gold, be long a cash/debt instrument of your choice. T-Bills, TIPS, Fed Funds, etc.

- If you're lazy, just do this two times a year with two halves of your portfolio.

- Split your portfolio into 10 buckets (or 4).

- Every January, look at the 10-year projected rate of return. If positive, buy or stay long for that bucket.

- If negative, sell or stay flat for that bucket.

- Each bucket should have at most one trade every 10 years.

- The entire portfolio should have at most one trade every year.

- When not long gold, be long a cash/debt instrument of your choice. T-Bills, TIPS, Fed Funds, etc.

- Use a 12-month moving average as your basis for being flat or long.

- During windows after which gold has reached an undervalued extreme, use a leveraged 1.5x long position.

- Stop using leverage once fair value has been established or the forward returns become negative.

- When not long gold, be long a cash/debt instrument of your choice. T-Bills, TIPS, Fed Funds, etc.

These are stupidly simple strategies. They're far from optimal. But they're conceptually sound, and don't incorporate any principles you wouldn't have been able to surmise after studying this data 20 or 30 years ago. Folks have been trend-following gold since day one. And while we may not actually buy when there's blood in the streets and valuations are depressed, at least we know we're supposed to. It's not unreasonable to build a strategy based on these basic factors.

Conclusion

I don't think there's any question that you can.

Whether you do something basic like own more gold when the secular valuation is favorable and less when it's unfavorable, or you use a classic trend-following approach, it's easy to do better over the long run. These types of strategies are dramatically superior to simply buying and holding gold.

However, I'll concede that this sort of defeats the purpose. The purpose of gold is to own gold! It's about holding this heavy stuff in the palm of your hand and being able to say, in a Jesse Pinkman voice, "Bring on the financial apocalypse!"

So, you're right. The one thing these approaches don't necessarily do is guarantee protection from some sort of acute crisis where the dollar implodes and gold basically goes to $5,000 overnight. A trend-following strategy, even with some cyclical adjustments to it, could theoretically have you out of gold and in short-term paper when that apocalypse hits. (Though wouldn't it be awesome if it had you in and leveraged when that happened?)

You can see how much the market is willing to pay for that insurance too. The difference in returns between simply holding gold and using some sort of enhanced gold trading strategy is dramatic. It's $8.9 million vs. $624k over 40 years.

Is this a price you are willing to pay?

If you subscribe the financial or currency apocalypse that's central to many gold bull theses, you have to be long gold -- the metal, yo -- at ALL TIMES. Because you never know when all the paper currencies in the world are going to drop to zero.

I have no interest in pushing against the idea that that'll happen. Neither you nor I can say with any sort of confidence what the future will look like. I simply want to point out the fact that the cost of thinking that it someday might has been substantial over the last few decades.

With a fair value target of $812/oz today, the forces of mean reversion are now working against gold. We won't all agree on that price target, of course. Even though, paradoxically, virtually every last one of us will agree on the fundamental premise upon which that conclusion is based.

Not all hope is lost, however. These strategies can help us do better no matter whatever the market throws our way.

0 comments:

Publicar un comentario