The economic future of Americans – some arithmetic

by Gavyn Davies

March 2, 2014 5:11 pm

American optimism is irrepressible and an enormous comparative advantage for the nation. Yet the actual economic experience of the median American has been rather disappointing in the past four decades, and there is pronounced pessimism among some economists about the medium term future.

For example, Robert Gordon of Northwestern University, a very distinguished academic, specialising in long term economic growth, predicts that the real living standards of all but the top 1 per cent in the income distribution will barely grow at all in the decades ahead. In other words, the economic performance of America may not be reflected in the experience of most Americans.

Such a gloomy forecast may seem startlingly improbable to most people, but the historic experience of the vast bulk of the population has been no better than that since 1973. Over the whole of that period, median real household income has actually risen by only 0.1 per cent per annum.

There are three main reasons for this – the profits share in the economy has risen at the expense of labour income; the distribution of labour income has become much more skewed in favour of the top 1 per cent, so the median (mid point) of the income scale has grown far more slowly than the average; and the rate of growth of productivity has fallen sharply for most of the period, despite the growth of information technology.

These factors are now well known and have been much debated. But Robert Gordon’s latest work goes even further, predicting almost no improvement into the indefinite future for the vast bulk of the population.

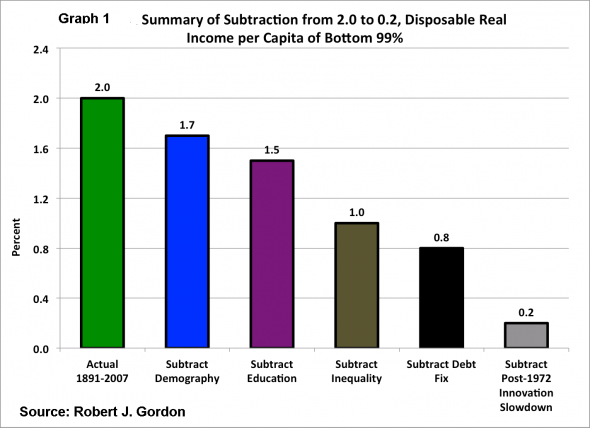

Gordon’s key assumptions about the 25 to 40 years after 2007 are shown in Graph 1 and in Table 1 (scenario (1)). Future productivity growth (output per hour) is very subdued, partly because of declining educational standards, and partly because Gordon is sceptical about the impact of the IT revolution on productivity growth.

In addition, the number of hours worked declines as the population ages, and the trend towards greater inequality incomes is projected indefinitely into the future. Finally, Gordon says that the budget deficit will have to be narrowed, in order to make America’s public debt sustainable, and he thinks that higher taxes will reduce real income growth for households.

Jan Hatzius at Goldman Sachs (no link available) has examined all of Gordon’s key assumptions, and concludes that the outlook is not quite as bleak as he says (scenario (2)). Hatzius points out that the trend in college attendance continues to expand strongly, so he does not see why the contribution of education to productivity growth should decline.

Hatzius also reckons that the rise in the profits share cannot continue indefinitely, and cites evidence that the share of the top 1 per cent in the wage distribution stopped rising in 1997. He therefore reckons that rising inequality will be much less of a factor in the decades ahead. Finally, he points out that any rise in taxes to pay the costs of health care for the ageing population will be received as transfer payments by old people, so real household income will not be reduced.

Hatzius’ less pessimistic arguments seem plausible to me, but the resulting future growth in median household income is still only 1-1.5 per cent per annum. The main factors retarding growth are twofold: first, Hatzius accepts that hours worked will decline for demographic reasons and, second, he agrees with Gordon that the growth in productivity has fundamentally slowed down since the “second industrial revolution”. He agrees with Gordon that the IT revolution will not make much of a contribution to accelerating productivity growth from now on.

It is this last assumption which is certainly the most controversial. Many economists are much more optimistic, arguing that the effects of the IT revolution will become cumulatively larger as they are applied in conjunction with robotic and biological advances. For example, Andrew McAfee and Erik Brynjolfsson’s influential book on the march of the robots identifies many reasons for believing that that the “second machine age” is only just starting. Martin Wolf, among others, is taking this possibility very seriously indeed.

Economists have not been at all successful in the past at predicting major inflection points in technical progress. This is not surprising. The difference between the optimistic and pessimistic camps on future technological trends cannot be based on much more than more than hunches and assertions. Those who think that technical progress is slowing down may just lack the imagination to envisage advances that have not been invented yet. Those who point to the exciting advances that are already in train may, on the other hand, forget that they have to be greater than earlier advances in order to result in faster productivity growth.

.

The strongest argument in favour of the pessimists’ case is the actual behaviour of productivity growth since 1972, which is much lower than longer term history (“indoor plumbing beats the IPad”). As Robert Gordon points out, output per hour since 1972 has risen by only about 1.3 per cent per annum, with the exception of the brief phase from 1996-2004, when it rose by 2.5 per cent under the impact of the IT revolution.

However, another, and much more optimistic, interpretation of this graph would be that the IT revolution, like previous technological break-throughs, is taking many decades to show its full effects on productivity. It could be argued that this was just starting to manifest itself in 1996-2004, but that the economy was then hit with the housing and financial shocks, which have retarded output and productivity growth for the last decade. [Footnote 1] When these shocks are fully absorbed, it is possible that productivity growth will return closer to the levels seen in 1996-2004, or at least to the very long term trends. I have built these assumptions into a more “optimistic” scenario (3) in Table 1.

One more important change has been built into the optimistic scenario. Real US GDP is currently more than 10 per cent below the very long term historical trend which existed for a century prior to 2007, and to which it has repeatedly returned after economic shocks. If real GDP is still “temporarily” depressed by the Great Recession, then there might be a rebound as the long term trend in demand is restored. Spread over 40 years, that would add almost 0.3 per cent per annum to the growth rate.

Of course, all of these figures should be treated with a great deal of scepticism. They are nothing more than partially-informed guesses. But a reasonably optimistic case can be constructed without stretching credulity too far.

Furthermore, it is crucial to recognise that many of the figures in the table are not pre-ordained, but are subject to policy choices in the future. There is no reason why the future of real income growth for most American households has to be as bleak as is often suggested. Policy makers should be expected to make better choices than they have done during the past four decades.

———————————————————————————————–

Footnote [1]

Interestingly, Paul Krugman and John Cochrane, who approach Robert Gordon’s papers from very different ends of the economic spectrum, both say that their “gut feeling” is that he is too pessimistic about the future of technology.

For example, Robert Gordon of Northwestern University, a very distinguished academic, specialising in long term economic growth, predicts that the real living standards of all but the top 1 per cent in the income distribution will barely grow at all in the decades ahead. In other words, the economic performance of America may not be reflected in the experience of most Americans.

Such a gloomy forecast may seem startlingly improbable to most people, but the historic experience of the vast bulk of the population has been no better than that since 1973. Over the whole of that period, median real household income has actually risen by only 0.1 per cent per annum.

There are three main reasons for this – the profits share in the economy has risen at the expense of labour income; the distribution of labour income has become much more skewed in favour of the top 1 per cent, so the median (mid point) of the income scale has grown far more slowly than the average; and the rate of growth of productivity has fallen sharply for most of the period, despite the growth of information technology.

These factors are now well known and have been much debated. But Robert Gordon’s latest work goes even further, predicting almost no improvement into the indefinite future for the vast bulk of the population.

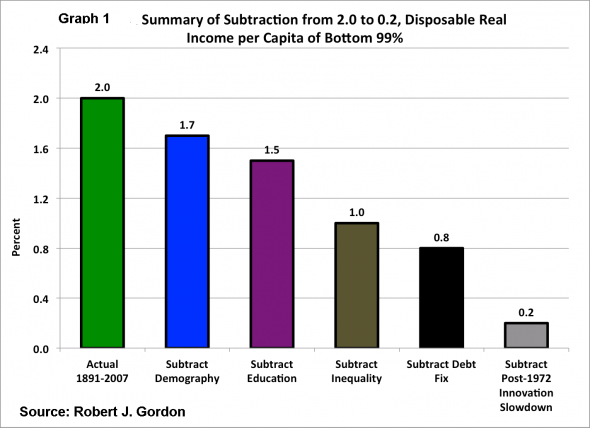

Gordon’s key assumptions about the 25 to 40 years after 2007 are shown in Graph 1 and in Table 1 (scenario (1)). Future productivity growth (output per hour) is very subdued, partly because of declining educational standards, and partly because Gordon is sceptical about the impact of the IT revolution on productivity growth.

In addition, the number of hours worked declines as the population ages, and the trend towards greater inequality incomes is projected indefinitely into the future. Finally, Gordon says that the budget deficit will have to be narrowed, in order to make America’s public debt sustainable, and he thinks that higher taxes will reduce real income growth for households.

Jan Hatzius at Goldman Sachs (no link available) has examined all of Gordon’s key assumptions, and concludes that the outlook is not quite as bleak as he says (scenario (2)). Hatzius points out that the trend in college attendance continues to expand strongly, so he does not see why the contribution of education to productivity growth should decline.

Hatzius also reckons that the rise in the profits share cannot continue indefinitely, and cites evidence that the share of the top 1 per cent in the wage distribution stopped rising in 1997. He therefore reckons that rising inequality will be much less of a factor in the decades ahead. Finally, he points out that any rise in taxes to pay the costs of health care for the ageing population will be received as transfer payments by old people, so real household income will not be reduced.

Hatzius’ less pessimistic arguments seem plausible to me, but the resulting future growth in median household income is still only 1-1.5 per cent per annum. The main factors retarding growth are twofold: first, Hatzius accepts that hours worked will decline for demographic reasons and, second, he agrees with Gordon that the growth in productivity has fundamentally slowed down since the “second industrial revolution”. He agrees with Gordon that the IT revolution will not make much of a contribution to accelerating productivity growth from now on.

It is this last assumption which is certainly the most controversial. Many economists are much more optimistic, arguing that the effects of the IT revolution will become cumulatively larger as they are applied in conjunction with robotic and biological advances. For example, Andrew McAfee and Erik Brynjolfsson’s influential book on the march of the robots identifies many reasons for believing that that the “second machine age” is only just starting. Martin Wolf, among others, is taking this possibility very seriously indeed.

Economists have not been at all successful in the past at predicting major inflection points in technical progress. This is not surprising. The difference between the optimistic and pessimistic camps on future technological trends cannot be based on much more than more than hunches and assertions. Those who think that technical progress is slowing down may just lack the imagination to envisage advances that have not been invented yet. Those who point to the exciting advances that are already in train may, on the other hand, forget that they have to be greater than earlier advances in order to result in faster productivity growth.

.

The strongest argument in favour of the pessimists’ case is the actual behaviour of productivity growth since 1972, which is much lower than longer term history (“indoor plumbing beats the IPad”). As Robert Gordon points out, output per hour since 1972 has risen by only about 1.3 per cent per annum, with the exception of the brief phase from 1996-2004, when it rose by 2.5 per cent under the impact of the IT revolution.

However, another, and much more optimistic, interpretation of this graph would be that the IT revolution, like previous technological break-throughs, is taking many decades to show its full effects on productivity. It could be argued that this was just starting to manifest itself in 1996-2004, but that the economy was then hit with the housing and financial shocks, which have retarded output and productivity growth for the last decade. [Footnote 1] When these shocks are fully absorbed, it is possible that productivity growth will return closer to the levels seen in 1996-2004, or at least to the very long term trends. I have built these assumptions into a more “optimistic” scenario (3) in Table 1.

One more important change has been built into the optimistic scenario. Real US GDP is currently more than 10 per cent below the very long term historical trend which existed for a century prior to 2007, and to which it has repeatedly returned after economic shocks. If real GDP is still “temporarily” depressed by the Great Recession, then there might be a rebound as the long term trend in demand is restored. Spread over 40 years, that would add almost 0.3 per cent per annum to the growth rate.

Of course, all of these figures should be treated with a great deal of scepticism. They are nothing more than partially-informed guesses. But a reasonably optimistic case can be constructed without stretching credulity too far.

Furthermore, it is crucial to recognise that many of the figures in the table are not pre-ordained, but are subject to policy choices in the future. There is no reason why the future of real income growth for most American households has to be as bleak as is often suggested. Policy makers should be expected to make better choices than they have done during the past four decades.

———————————————————————————————–

Footnote [1]

Interestingly, Paul Krugman and John Cochrane, who approach Robert Gordon’s papers from very different ends of the economic spectrum, both say that their “gut feeling” is that he is too pessimistic about the future of technology.

0 comments:

Publicar un comentario