Don't Be Fooled By Gold Price Action

Feb. 14, 2014 10:19 AM ET

by: Evariste Lefeuvre

.

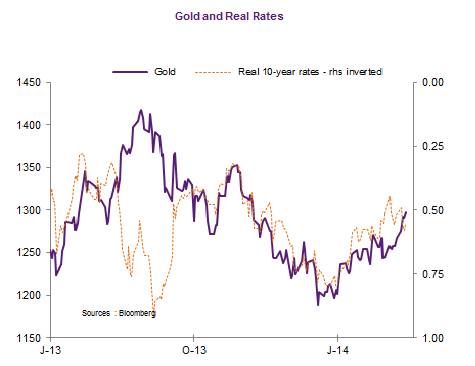

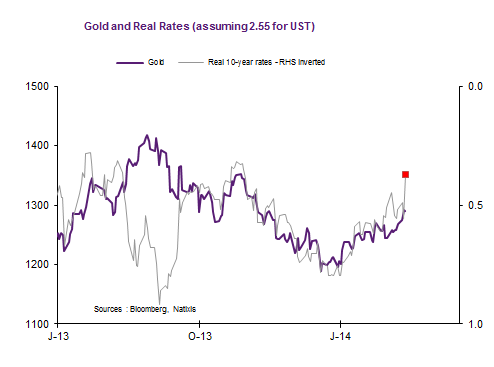

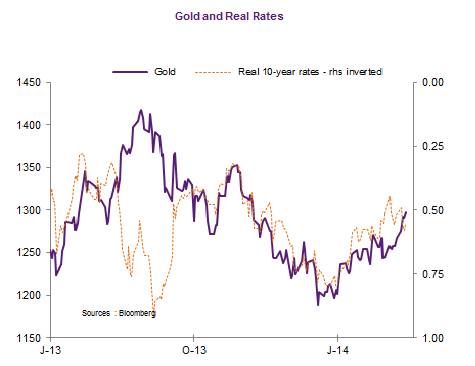

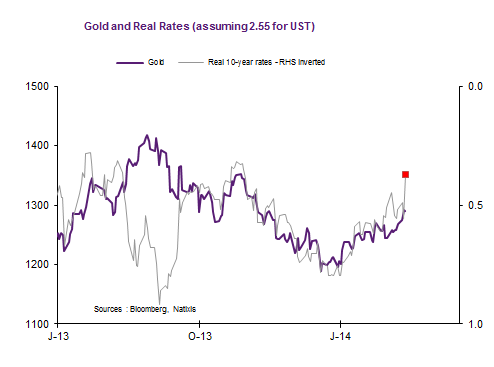

At first glance, gold prices are in sync with the direction suggested by real interest rates (see chart below).

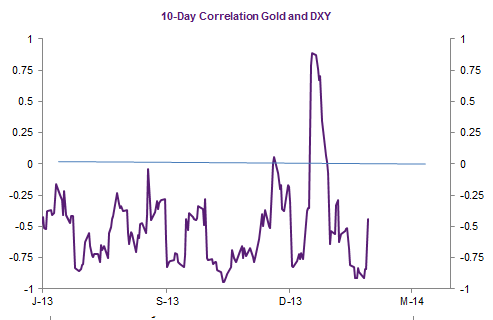

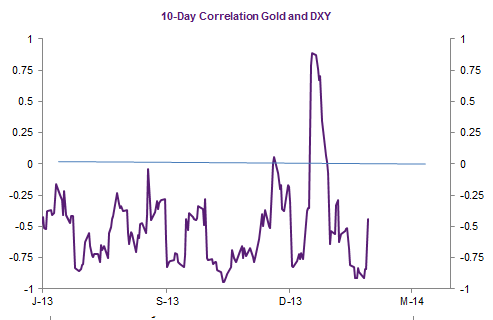

The correlation between gold and the US dollar remains negative (after a blip in positive territory in early 2014). As the USD has drifted upward since the beginning of the year, this move should have partially curbed the rise of the yellow metal.

So gold prices are once again driven mostly by US real yields. The question is where could those rates be heading?

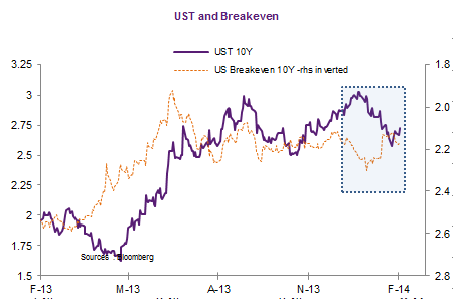

On the nominal front, UST yields are closely following the US news flow, not the jitters on emerging markets. I would not rule out a fall down to the 2.55% area in the short run (even 2.46%), especially since Yellen proved rather dovish on forthcoming rate hikes.

Regarding tapering though, the word "significant" is strong enough for me to rule out any change in the tapering stance barring a dire negative strong shock on growth. Therefore, given my nominal growth forecast for US GDP growth in 2014, I would clearly lean toward UST yields around 3.25% at year-end.

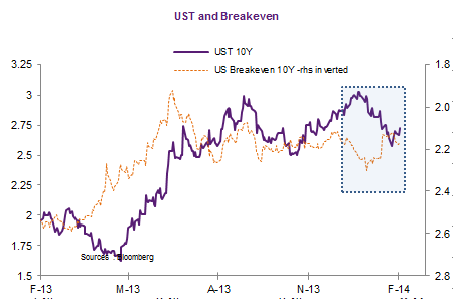

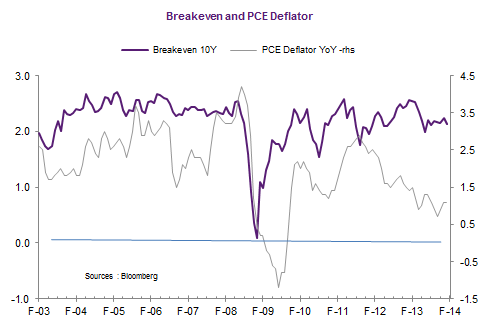

Interestingly enough, and contrary to the normal relationship, the US 10-year inflation breakeven disconnected in late 2013 from nominal yields, first falling when nominal yields went up and then moving up while nominal yields were receding - a move that accentuated the downward trend in real yield and sustained the rise in gold.

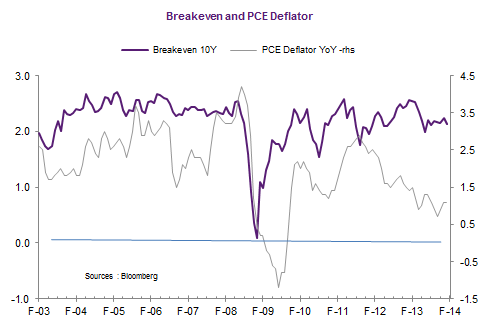

A look at the chart below shows that the disconnect between the Fed inflation target (PCE deflator) and expected inflation is historically wide. It shows the success of the Fed in steering and anchoring long-term inflation expectations, but it would nonetheless suggest a slightly lower inflation breakeven rate in the near future. Said differently, inflation expectations (or its proxy here, inflation breakeven) should fall in the near future, bringing upward pressure on real yields, hence a negative pressure on gold prices.

Bottom Line: in the short run, barring any improvement in the news flow, US Treasuries nominal yields have some room to fall a little more. Given the stickiness of inflation expectations, real yield could fall sufficiently for gold prices to rise a little further. I see the 1,400 area as an upper limit (see chart below).

Yet, given the current disconnect of inflation expectations and the PCE deflator trend, it would be very challenging to expect real yields to breach the zero threshold as inflation expectations will have to adjust on the downside any time soon.

As a result gold may go up slightly above the 1,300 threshold, but any further rise would be challenging as the odds for much lower real yields are very low: tapering + GDP growth + disconnect between inflation B/E and observed inflation.

The correlation between gold and the US dollar remains negative (after a blip in positive territory in early 2014). As the USD has drifted upward since the beginning of the year, this move should have partially curbed the rise of the yellow metal.

So gold prices are once again driven mostly by US real yields. The question is where could those rates be heading?

On the nominal front, UST yields are closely following the US news flow, not the jitters on emerging markets. I would not rule out a fall down to the 2.55% area in the short run (even 2.46%), especially since Yellen proved rather dovish on forthcoming rate hikes.

Regarding tapering though, the word "significant" is strong enough for me to rule out any change in the tapering stance barring a dire negative strong shock on growth. Therefore, given my nominal growth forecast for US GDP growth in 2014, I would clearly lean toward UST yields around 3.25% at year-end.

Interestingly enough, and contrary to the normal relationship, the US 10-year inflation breakeven disconnected in late 2013 from nominal yields, first falling when nominal yields went up and then moving up while nominal yields were receding - a move that accentuated the downward trend in real yield and sustained the rise in gold.

A look at the chart below shows that the disconnect between the Fed inflation target (PCE deflator) and expected inflation is historically wide. It shows the success of the Fed in steering and anchoring long-term inflation expectations, but it would nonetheless suggest a slightly lower inflation breakeven rate in the near future. Said differently, inflation expectations (or its proxy here, inflation breakeven) should fall in the near future, bringing upward pressure on real yields, hence a negative pressure on gold prices.

Bottom Line: in the short run, barring any improvement in the news flow, US Treasuries nominal yields have some room to fall a little more. Given the stickiness of inflation expectations, real yield could fall sufficiently for gold prices to rise a little further. I see the 1,400 area as an upper limit (see chart below).

Yet, given the current disconnect of inflation expectations and the PCE deflator trend, it would be very challenging to expect real yields to breach the zero threshold as inflation expectations will have to adjust on the downside any time soon.

As a result gold may go up slightly above the 1,300 threshold, but any further rise would be challenging as the odds for much lower real yields are very low: tapering + GDP growth + disconnect between inflation B/E and observed inflation.

0 comments:

Publicar un comentario