Zooming Monetary Base Supporting Equity Markets

Oct, 19 2013, 06:45

As the US equity markets hit a new record high, one is left wondering on how much higher the markets can go. This article discusses the reasons for the current rally and the headwinds facing the markets. The broad conclusion is that investors need to avoid buying into stocks at these levels. It would also be a good idea to sell some relatively high beta names and invest in defensive stocks to avoid capital erosion.

I must admit first that the US economy has shown considerable resilience and the Eurozone is also on its path to recovery.

However, are things good enough to result in markets trading at record high levels?

In my opinion, it is certainly a no. I will discuss the reasons for the same later. First, let's have a look at the reason for markets surging to record highs.

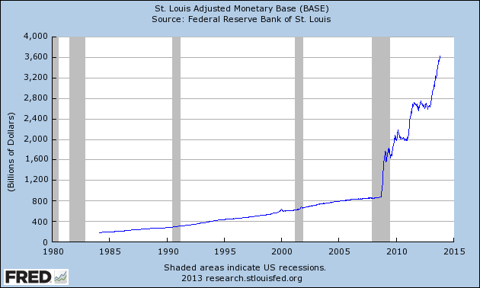

Accommodative monetary policies can easily be judged by the trend in the adjusted monetary base. Highly accommodative monetary policies create a liquidity glut and can result in certain asset classes going higher. Also, when there is ample liquidity in the system, there is a swift movement of money from one asset class (which looks overvalued) to another asset class. This is one of the biggest risks in the current scenario.

The chart below gives the US adjusted monetary base. It is clear that the adjusted monetary base has zoomed higher in the recent past after a period of relative stagnancy. The immediate outcome has been a relatively higher liquidity glut and more speculation in risky asset classes.

Investors might suggest that there might be no speculation in the market and the surge in equities is backed by strong fundamentals. I would point to the margin debt data, which remains at record highs and does suggest that there is ample amount of speculation in the markets.

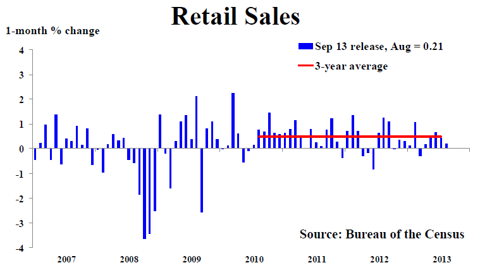

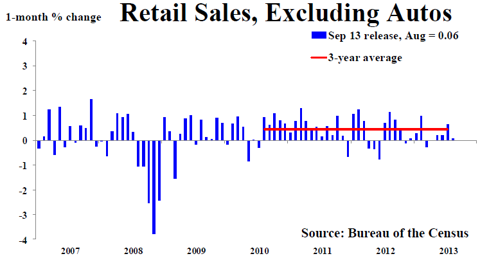

On the current economic activity, I did mention that the US economy has shown resilience, but it is certainly not good enough to justify the recent surge in the markets. I would look at a critical economic indicator for the United States (retail sales). As the charts below show, the retail sales are well below the 3-year average (including and excluding autos). It therefore leaves me wondering if the economic scenario is any better than it was few months or a year back. The Fed deciding not to taper also suggests that the economy is not getting any better at this point of time. Certainly, robust economic activity is not the reason for the recent surge in markets. The current S&P 500 PE of 18 looks expensive considering the fact that the economy still needs support to sustain.

I would therefore advise that investors stay away from the markets and avoid any fresh exposure. Investors can also consider trimming their positions in the markets or switching to relatively defensive stocks. I am also of the opinion that gold might have another bout of rally in 2014 as expansionary monetary policies continue. Investors can also consider buying into gold ETFs or physical gold at these levels.

Some recommendation, which might work well for investors:

Johnson & Johnson (JNJ) is a good long-term investment option. I like this highly diversified healthcare company with product as well as regional diversification. Further, the sector JNJ caters to is not very prone to economic shocks. JNJ has been a good dividend payer in the past, with a dividend yield of 2.9%. In my opinion, the stock is excellent for a long-term portfolio. It also commands a higher rating than the U.S. sovereign rating.

Procter & Gamble (PG) is another good stock in the consumer and personal care segment with a good dividend yield of 3.0%. I must mention here that PG has been an investor-friendly company having returned $88 billion to shareholders through dividends and share repurchase in the last 10 years. In terms of business growth, PG revenue contribution from Asia has increased from 15% in 2009, to 18% in 2012. Also, sales have grown at a CAGR of 23%, 25%, 27% and 17% in Brazil, Russia, India and China respectively in the last 10 years. Going forward, emerging markets will continue to be the growth driver for PG.

SPDR Gold Shares (GLD): The investment seeks to replicate the performance, net of expenses, of the price of gold bullion. After the significant correction, gold does look attractive for long-term and can be considered as an integral part of a well diversified portfolio.

0 comments:

Publicar un comentario