It Could Be A Long Summer Ahead For Gold Bulls

Jun 30 2013, 10:17

by: Tim Iacono

Another round of lowered price forecasts for precious metals combined with more outflows from ETFs to spur yet another sell-off for gold and silver. A short-covering rally late in the week recouped some of those losses, but, absent a new catalyst to drive metal prices higher, the trend remains decidedly down as the gold price closed out its worst quarter in more than four decades.

Fears of the Federal Reserve winding down its money printing effort sooner rather than later, rising bond yields, declining inflation expectations, and a stronger dollar were all cited for last week's decline. Perhaps more importantly, lower prices have not prompted another big surge in physical demand in Asia, traditionally the world's biggest buyer of gold, and this does not bode well for gold and silver prices over the summer.

Predictions for a triple-digit gold price are becoming more common as the key drivers for the decade long rise in precious metals have all reversed in recent months. However, there are also an increasing number of calls for a bottom in metal prices after the unprecedented selling in recent months.

For the week, spot gold plunged 4.9 percent, from $1,298.60 an ounce to $1,235.30, and silver fell 2.3 percent, from $20.12 an ounce to $19.66. Gold is down 26.3 percent so far in 2013, some 35.8 percent below its all-time high of over $1,920 an ounce in 2011, and silver is down 35.2 percent this year, over 60 percent below its record high reached over two years ago.

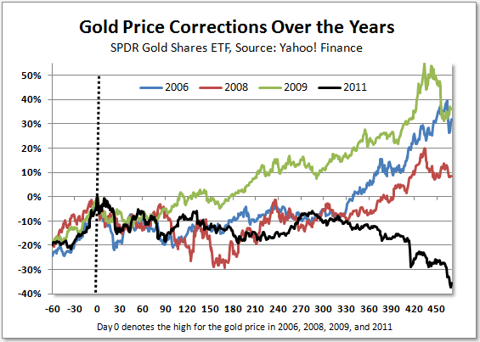

To be sure, this is clearly no longer a run-of-the-mill correction and anyone who still thinks that is the case should be disabused of that notion after studying the graphic below.

(click to enlarge)

I haven't updated this chart in a while and it's pretty stunning.

Long-term gold bulls are making more comparisons to the 47 percent decline that occurred in 1975-1976, at about the midpoint of the last secular gold bull market that ended in 1980. This occurred prior to the gold price rising nearly seven-fold in the late-1970s.

Importantly, a similar decline today would take the gold price back down to just over $1,000 an ounce.

Bears conclude that gold's decade long run is all but over, the only important question being how low prices will go before hitting bottom and then, perhaps, mounting another multi-decade long comeback.

I'm clearly in the former camp, however, there's no telling how long this mid-cycle swoon will last and how low prices might go. Predictions of gold at $800 an ounce are not uncommon these days since, over the near-term, there is little potential for market trends or economic data to reverse the move by U.S. investors out of gold and into other asset classes.

In the West, where gold and silver prices are set, the metals are largely perceived to be "just another financial asset" whose price can be bid higher or lower and now it's going lower for a number of reasons.

But no other "financial asset" has served as money for thousands of years and, at a time when paper money looks as shaky as ever, investors have all but forgotten the world's long monetary history that has seen no pure fiat money system stand the test of time. Debt at all levels remain near record highs and central banks continue to create trillions of dollars in new money to spur growth, now more than four years after the end of the last recession. Yet, there is little fear today of another financial crisis or sharply higher inflation over the long-term.

The view of Sean Corrigan, chief investment strategist at Diapason Commodities Management, via this Reuters story captures my sentiment:

We bought gold for two reasons - because we were worried about the inflationary impact of policy and because we thought the financial system was going to fall apart. Although it may be the wrong judgment, the market has decided that none of those at the moment is a concern.

Investment banks see little reason for clients to be buying gold or silver these days and a slew of new, lower forecasts were released just last week. There appears to be an evolving consensus that metal prices are headed back to the "pre-QE days," implying a gold price at or below $1,000 an ounce. In an interview at CNBC last week, Tom Kendall, director and head of precious metals research at Credit Suisse, advised investors to re-examine their expectations for gold and start thinking about the metal in "pre-crisis" terms.

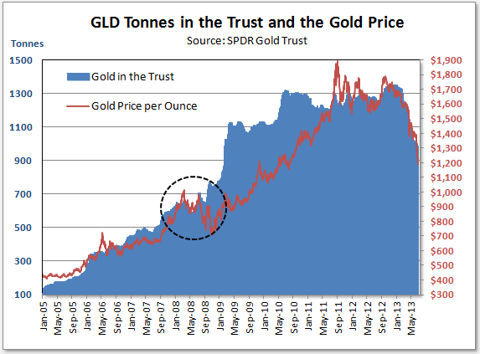

While Kendall cited the $1,100 to $1,150 an ounce price range in his comments, a closer look at the pre-crisis data shows the gold price and holdings for the SPDR Gold Shares ETF (GLD) in a fairly tight range back in 2008 as shown below, the former well below $1,000.

(click to enlarge)

Last week, outflows from GLD totaled 20.4 tonnes, more than the 13.6 tonnes that exited the trust the week before and far more than the average of just 4.2 tonnes in late-May/early-June.

Goldman Sachs' analysts provided new gold price forecasts, citing ongoing ETF outflows among other reasons for their lowered targets. They reduced their 2013 year-end forecast by almost 10 percent to $1,300 an ounce with a further decline to $1,050 by the end of 2014, down nearly 20 percent from its earlier outlook.

Morgan Stanley, Deutsche Bank, UBS, and HSBC also cut their average 2013 gold price forecasts to $1,409, $1,431, $1,440, and $1,396, respectively. Surprisingly, all of these forecasts imply a rising gold price in the second half of the year since gold averaged $1,524 an ounce during the first six months.

A rare positive view on gold came from the CPM Group in A Qualified Buy Recommendation On Gold on Thursday. One look at the main page of the company's website urges caution, however, as it contains a link to an April 19th article titled, "Gold & Silver Lows Are In; US Mint Silver Shortages Are Misleading."

As noted last week in Owners Of The iShares Silver Trust Are A Persistent Bunch, holdings at the iShares Silver Trust ETF (SLV) have been much steadier than for GLD. Though 168 tonnes exited the SLV trust last week, the holdings are down just 180 tonnes since the beginning of the year, or less than two percent, despite the price of the metal tumbling 20 times that amount.

Despite what appears to be an acceleration in selling of precious metals in the West, demand remains strong in the East. A report on Friday indicated a renewed gold rush in Dubai where Tarek El Mdaka, the managing director of Kaloti Gold, said he has been importing "one-and-a-half to two tonnes of gold every day and it is going straight out." As an interesting point of reference - and yet one more indication of how gold is flowing from the West to the East - Kaloti Gold is now importing gold at about the same rate as the SPDR Gold Shares ETF is shedding it.

But, as compared to the spectacular surge in physical demand that followed the gold price plunge in April, buying in Asia has been subdued over the last week or so. This is due in large part to the ongoing efforts of the Indian government to curb gold demand in order to narrow their trade deficit and boost their currency that has recently fallen to record lows. The passing of peak wedding season is also a factor as the lack of demand in the West is likely to result in seasonal patterns re-emerging. Importantly, summer is the weakest season of all for gold buying in India.

Lastly, cognizant of the prospect that the gold price may now fall even further, there appears to be a growing sense that the world's most cost sensitive gold buyers in Asia might just wait and see how much lower prices go before buying much more.

It is shaping up to be a long summer ahead for gold bulls.

0 comments:

Publicar un comentario