I Understand The Price Of Gold

Jul 23 2013, 13:19

by: Willem Middelkoop

"Nobody really understands gold prices and I don't pretend to understand them either"

- Ben Bernanke during the Senate Banking Committee hearing on Thursday July 19th

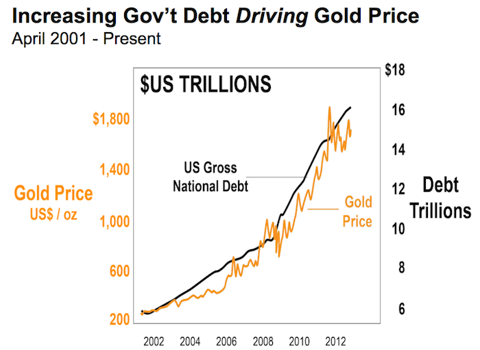

Please Mr. Bernanke, speak for yourself. After studying the price of gold for 15 years and writing about it since 2002, I know the price of gold shows a close correlation with the supply of money. When more money chases the same amount of gold, (per capita) gold tends to go up in value. Gold follows global liquidity.

.

.

And after the recent 35% correction (not in this chart), gold has to catch up with the rise of global liquidity again (QE totaled $10 trillion worldwide, since 2008).

So it wasn't that scary to write as early as 2002;

"A rising gold price weakens the position of the US dollar and highlights doubts about world's financial system"

.. or to predict the gold price would rise to $1200, $1500 or even $2000 in 2008, when gold traded around $800.

Proof of the fact that gold has around the same value as 2,000 years ago, can be found in the Museum of London. On display is a Roman "aureus" coin, which contains 8 grams of 22 carat (90%) gold. According to the details printed next to it, 8 aurei could buy you a boy slave at that time and one aurei some 400 litres of cheap wine.

Since I don't know the current price of a boy slave, I decided to check how many liters of cheap wine one could buy for eight grams of 22 carat gold nowadays. One gram of 22 carat gold is currently valued at around 30 euro per gram. Eight grams, then, will give you roughly 240 euros to buy wine. When bought in small cartons, one can still buy wine in Europe for around one euro per litre. So 240 euros will give you 240 litres of cheap wine. Before the recent 35% correction in the gold price, one would have been able to buy around 350 litres, which comes close to our Roman example.

We can then conclude two things;

1- Gold has held its value pretty well over the last 2,000 years

2- Gold currently seems undervalued, probably by as much as 30%

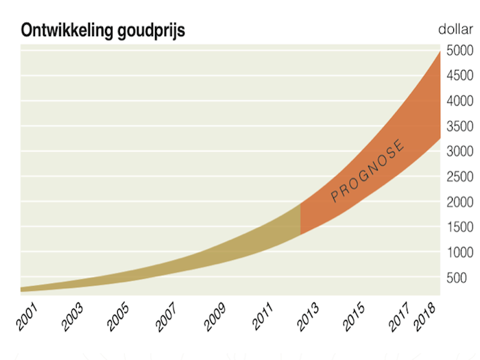

With infinite QE ongoing, this is my (Dutch) prognosis for the gold price for the coming years.

Can somebody send it to Mr. Bernanke please?

Source: I Understand The Price Of Gold

0 comments:

Publicar un comentario