Precious Metals Defy Logic

May 23 2013, 06:22

To say we're going through interesting times is an understatement, not only in precious metals but the overall market. However in this article I will stick to discussing the irrationality of precious metals. My point of view tackles this from an industry perspective that is overlooked by most.

In a previous article I wrote how understanding production costs would enhance anyone's view and further enhance one's insight on trading precious metals. While it is true that technicals can fly in the face of fundamentals, this is generally short lived as the underlying fundamentals will always drive direction.

The reason I say precious metals defy logic is that there is a clear divergence between the trading of physical gold/silver and electronic/paper trades.

Physical demand of the metals has been overwhelming with supplies run off the shelf. Mints around the world are too out of stock. Here is an article that gleans some information on it.

At the same time electronically traded Gold and Silver are at multi year lows and unsustainable at that too.

Sustainability

There are a few reasons why gold isn't sustainable and at these levels it makes quite the bargain for those in the know.

To begin with, production cost is around the current value of gold. Previously I mentioned I'd be surprised to see gold dive under $1300/Oz and silver $21/Oz and if it did that it would be short lived. While production costs vary from speaking to industry experts it appears $1300 is average, however it can vary from $1000 to $1450 an ounce.

Australia is one of the major gold producers and the current price in gold is causing gold miners to hemorrhage and shut business. For more information take a look at this article on the shutdown of mines.

While it has been argued that gold has had a huge bull run and far exceeded inflationary pressures, this does not take into account the underlying costs of producing gold. In fact the costs have raised proportionately with the rise in gold price.

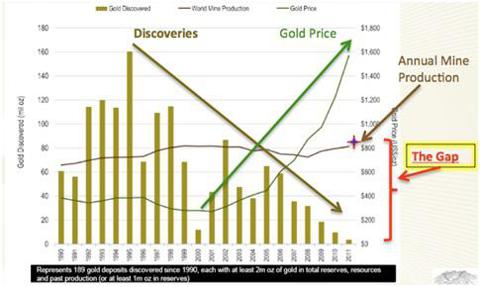

Next we'll look at supply. Gold discoveries are no longer keeping pace with production as all the easier found gold has been mined and with rising costs in production and exploration it isn't as feasible to produce as it has been in the past.

In the 1980s there was a surge in the supply of gold and this was due to a technology innovation called Carbon in Leach. This meant that lower grade gold previously not able to be mined was now able to be retrieved.

What about the existing gold? This is a common question and surprisingly a lot of the gold traded isn't gold already in existence and relies on new supply to the market. Countries like China, India and the Middle East make up most of the demand on precious metals. With the recent low prices, widespread demand has caused physical shortages. Their culture has always had a demand for precious metals for jewelry purposes and as the lower class moves up to the middle class, the demand is only going to become stronger.

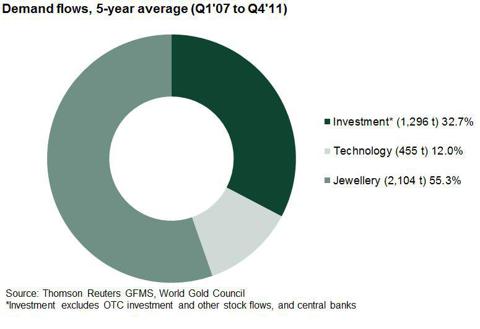

Having a look at data from the World Gold Council, most gold demand is not for investment purposes and is used for jewelry.

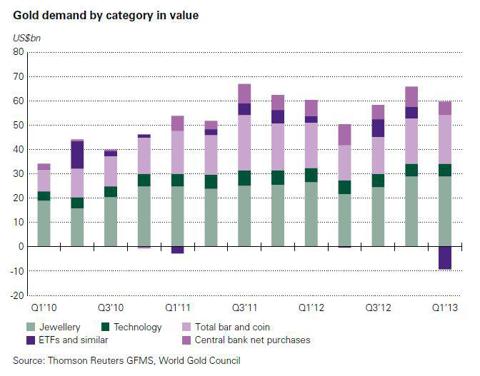

The next graph shows demand by category.

As mentioned earlier the amount of gold discoveries is rapidly diminishing and there is no technology on the horizon to mine the lower grade or harder-to-find gold.

Gold Miners

Taking note of the above, how do gold miners remain profitable? Well quite simply they aren't and they have been struggling. Over recent times it really has been a case of survival of the fittest. Looking at the below graph comparing the Gold Miners ETF (GDX) with the Gold Index ETF (GLD), it shows quite the drop on the part of gold miners. However by now this shouldn't come as much of a surprise.

Conclusion

While I have raised many points that may surprise a few of you, I merely wish to highlight the reality behind gold and where it is heading in the future. As for the recent correction in the gold price, that's another story.

While I'm not one for conspiracy theories, it should be noted that central banks up until the global financial crisis were net sellers of gold and since then they have been net buyers.

My view is that gold and silver are at bargain prices. For illustration purposes, it doesn't take an expert to realize if it costs $10 to make a brand-named shoe then purchasing it at $10 is a steal.

How you apply that view, however, is the question and there are numerous ways to express that. ETFs such as the Gold Index and Silver Index (SLV) are easy to gain exposure to the metals without the use of complex derivatives or options.

In summary I remain rather bullish on precious metals, however bearish on gold miners.

0 comments:

Publicar un comentario